Guard Veterans Healthcare Act debated as lawmakers weigh Medicare Advantage consequences

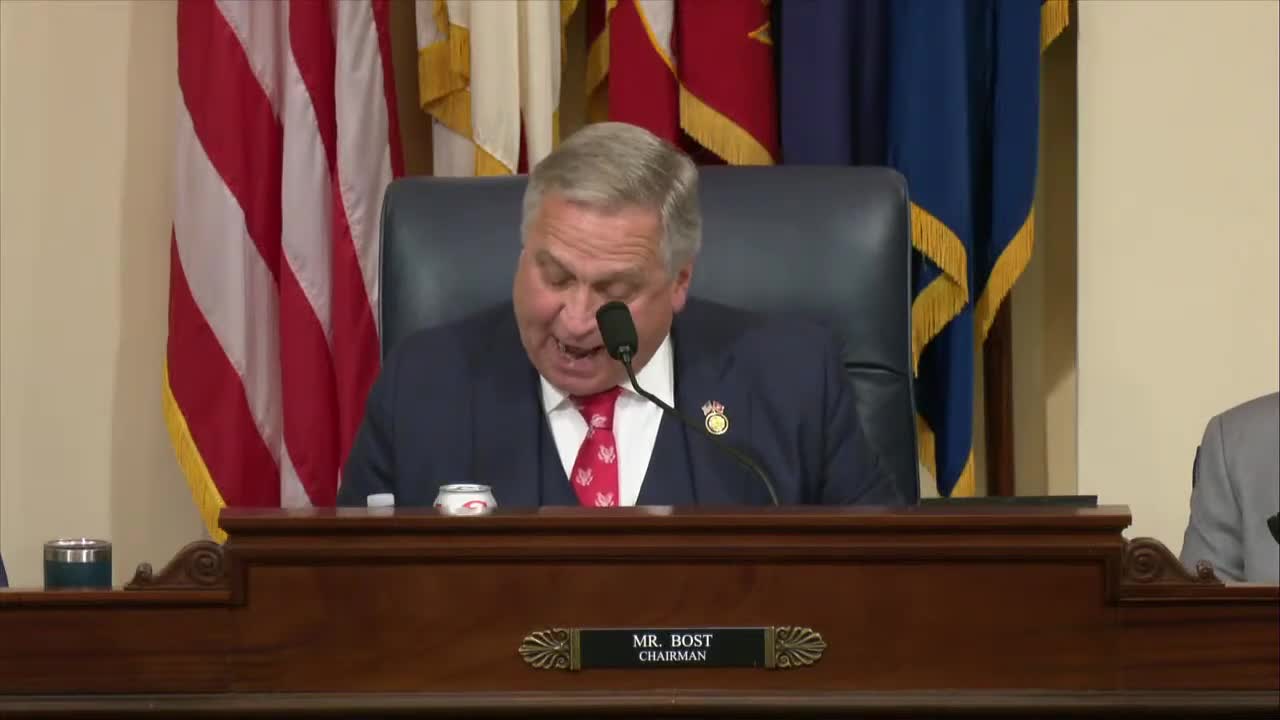

December 04, 2025 | Veterans Affairs: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Representative Doggett and several co‑sponsors presented HR 4077 (Guard Veterans Healthcare Act) to the House Veterans' Affairs Committee, saying the bill would allow the Department of Veterans Affairs to recover costs from Medicare Advantage and Part D plans for care VA provides to dually enrolled veterans. Doggett cited reporting and academic work showing private plans have profited from a reimbursement gap and noted CBO estimates that collections could reach approximately $10 billion annually.

Why it matters: Supporters say correcting the reimbursement exemption closes a taxpayer duplication loophole and strengthens VA finances. Critics warn that post‑service billing could shift costs onto Medicare’s mandatory side, raise premiums, narrow networks, and reduce supplemental benefits for seniors.

Support and concerns: Representative Doggett argued insurers are advantaged because they keep premiums while VA provides the care; he said HR 4077 merely asks Medicare Advantage plans to treat VA like any other provider. The Veterans of Foreign Wars and other VSOs told the committee they back the bill’s reimbursement objective but urged careful implementation and oversight to avoid administrative burdens and potential improper cost‑shifts.

Policy alternatives discussed: Dr. Brian Miller (testifying in personal capacity) and several members emphasized that administrative fixes—permanent VA‑CMS data sharing, use of the VA‑DOD adjuster for MA benchmarks, improved prepayment claims processes, and front‑end care coordination—could reduce duplicative payments and may be preferable to after‑the‑fact billing that could increase Medicare program costs. VA witnesses said they support the bill’s objective but are still analyzing how collections would interact with Medicare trust funds and the department’s authority to bill MA plans.

Fiscal mechanics and unanswered questions: Committee members pressed whether VA collections would reduce federal mandatory spending or simply move costs into Medicare, and whether Medicare Advantage benchmarks already adjust for VA spending. VA revenue officials and Devlin deferred some of those fiscal questions and said they would consult further; they also said they had not completed analyses of programmatic consequences such as whether MA plans would reduce enrollment among veterans.

Next steps: The committee did not vote. Members asked for additional analysis from VA and CBO on fiscal interactions, potential beneficiary impacts, and possible front‑end coordination solutions before markup.

Attributions: The article uses testimony from Representative Doggett (bill co‑lead), Dr. Brian Miller (policy witness), Christina Keenan (VFW), and VA witnesses including Margarita Devlin and Kevin Johnson.

Why it matters: Supporters say correcting the reimbursement exemption closes a taxpayer duplication loophole and strengthens VA finances. Critics warn that post‑service billing could shift costs onto Medicare’s mandatory side, raise premiums, narrow networks, and reduce supplemental benefits for seniors.

Support and concerns: Representative Doggett argued insurers are advantaged because they keep premiums while VA provides the care; he said HR 4077 merely asks Medicare Advantage plans to treat VA like any other provider. The Veterans of Foreign Wars and other VSOs told the committee they back the bill’s reimbursement objective but urged careful implementation and oversight to avoid administrative burdens and potential improper cost‑shifts.

Policy alternatives discussed: Dr. Brian Miller (testifying in personal capacity) and several members emphasized that administrative fixes—permanent VA‑CMS data sharing, use of the VA‑DOD adjuster for MA benchmarks, improved prepayment claims processes, and front‑end care coordination—could reduce duplicative payments and may be preferable to after‑the‑fact billing that could increase Medicare program costs. VA witnesses said they support the bill’s objective but are still analyzing how collections would interact with Medicare trust funds and the department’s authority to bill MA plans.

Fiscal mechanics and unanswered questions: Committee members pressed whether VA collections would reduce federal mandatory spending or simply move costs into Medicare, and whether Medicare Advantage benchmarks already adjust for VA spending. VA revenue officials and Devlin deferred some of those fiscal questions and said they would consult further; they also said they had not completed analyses of programmatic consequences such as whether MA plans would reduce enrollment among veterans.

Next steps: The committee did not vote. Members asked for additional analysis from VA and CBO on fiscal interactions, potential beneficiary impacts, and possible front‑end coordination solutions before markup.

Attributions: The article uses testimony from Representative Doggett (bill co‑lead), Dr. Brian Miller (policy witness), Christina Keenan (VFW), and VA witnesses including Margarita Devlin and Kevin Johnson.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee