Ashland County committee hires realtor to market tax-delinquent parcels

November 19, 2025 | Ashland County, Wisconsin

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

The Ashland County Zoning and Land Committee voted Aug. 5 to hire Anthony “Tony” Jennings of Crew Real Estate to market county-held, tax-delinquent properties.

County staff told the committee it issued an RFP to area realtors and "we got the 1 response back from, Anthony Jennings in Crew Real Estate," and recommended negotiating with that respondent. Pat Kenny moved to approve Jennings as the county’s realtor and Jim Schultz seconded; the motion carried with no recorded opposition.

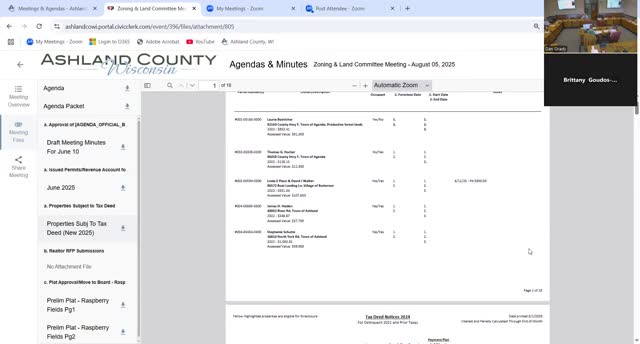

The decision follows a large increase in the committee’s delinquent-tax list after staff began sending notices for 2022 delinquencies. County staff reported the list has grown but that individuals will come off the list as statutory deadlines are met.

Members discussed how the county should treat low-value or problem properties. Pat Kenny and others cautioned against automatically foreclosing on parcels that create more cost than value, debating whether to pursue foreclosure, demolition, or conditional sale to a rehabilitator. One council member asked whether the county can sell a property for a nominal price “on the condition they make it habitable within, you know, a year,” and the committee agreed corporate counsel should advise on legal limits.

Committee members repeatedly flagged a recent state law change requiring an attempt to sell delinquent property at market value before other dispositions. County staff said that requirement means the county must consult corporate counsel about whether it can impose post-sale rehabilitation conditions and how realtor fees affect funds available to prior owners under statute.

Members also discussed commission and incentive structures for low-dollar parcels. The committee debated a minimum fee per parcel versus a standard commission percentage; one proposal discussed during the meeting was a $1,000 minimum or the commission rate, whichever is greater, to better incentivize sales of small parcels. Members asked staff and counsel to confirm what realtor fees are permissible under state statute so that any fees do not improperly reduce proceeds due to former owners.

After the vote the committee directed staff to finalize contract language and negotiate terms between county staff, corporate counsel, and Jennings before listing properties. Committee members said the goal is to move desirable parcels back onto the tax rolls while avoiding county ownership of properties with no resale value.

The committee’s action was procedural: it authorized staff to proceed with Jennings as the county realtor and to return to committee or coordinate with counsel if legal or payment issues require further guidance.

County staff told the committee it issued an RFP to area realtors and "we got the 1 response back from, Anthony Jennings in Crew Real Estate," and recommended negotiating with that respondent. Pat Kenny moved to approve Jennings as the county’s realtor and Jim Schultz seconded; the motion carried with no recorded opposition.

The decision follows a large increase in the committee’s delinquent-tax list after staff began sending notices for 2022 delinquencies. County staff reported the list has grown but that individuals will come off the list as statutory deadlines are met.

Members discussed how the county should treat low-value or problem properties. Pat Kenny and others cautioned against automatically foreclosing on parcels that create more cost than value, debating whether to pursue foreclosure, demolition, or conditional sale to a rehabilitator. One council member asked whether the county can sell a property for a nominal price “on the condition they make it habitable within, you know, a year,” and the committee agreed corporate counsel should advise on legal limits.

Committee members repeatedly flagged a recent state law change requiring an attempt to sell delinquent property at market value before other dispositions. County staff said that requirement means the county must consult corporate counsel about whether it can impose post-sale rehabilitation conditions and how realtor fees affect funds available to prior owners under statute.

Members also discussed commission and incentive structures for low-dollar parcels. The committee debated a minimum fee per parcel versus a standard commission percentage; one proposal discussed during the meeting was a $1,000 minimum or the commission rate, whichever is greater, to better incentivize sales of small parcels. Members asked staff and counsel to confirm what realtor fees are permissible under state statute so that any fees do not improperly reduce proceeds due to former owners.

After the vote the committee directed staff to finalize contract language and negotiate terms between county staff, corporate counsel, and Jennings before listing properties. Committee members said the goal is to move desirable parcels back onto the tax rolls while avoiding county ownership of properties with no resale value.

The committee’s action was procedural: it authorized staff to proceed with Jennings as the county realtor and to return to committee or coordinate with counsel if legal or payment issues require further guidance.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee