County to accept Village of Paw Paw settlement over missed PILOT distributions

November 14, 2025 | Van Buren County, Michigan

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

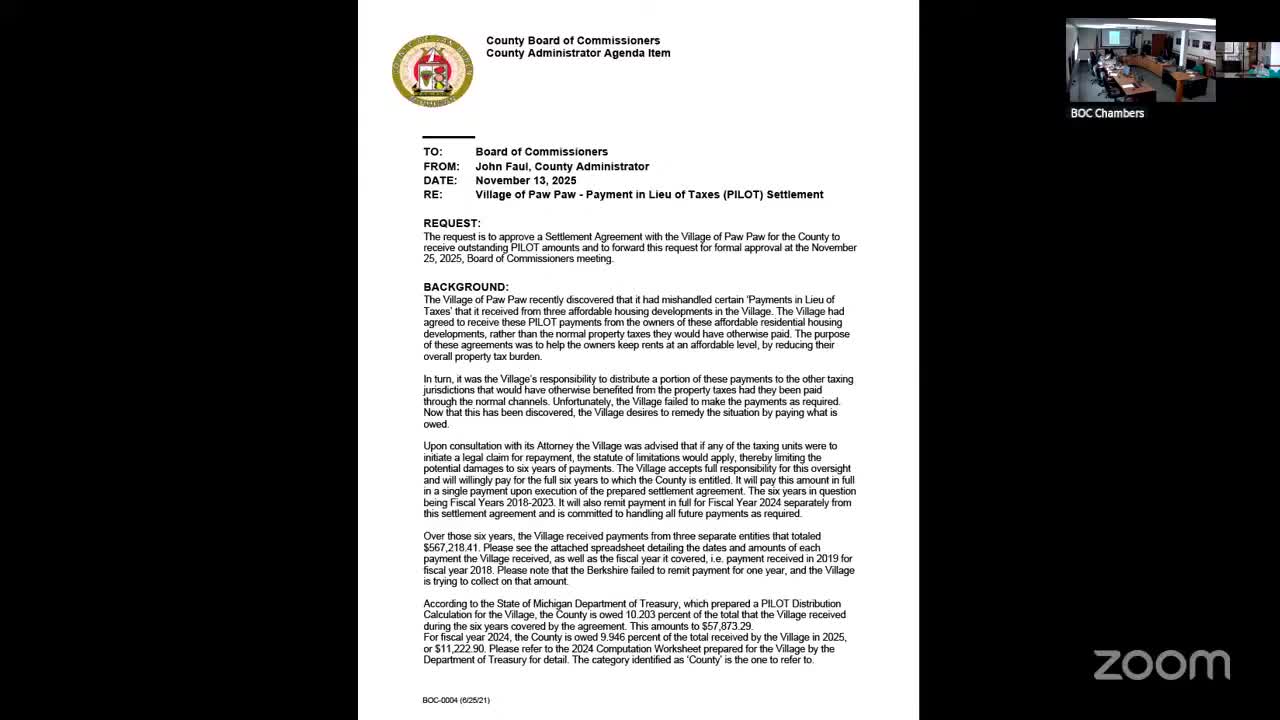

The Van Buren County Board of Commissioners agreed Nov. 13 to move forward with a settlement offer from the Village of Paw Paw to resolve years of missed distributions tied to payment-in-lieu-of-taxes (PILOT) agreements.

Village staff told the board that prior PILOT receipts had not been distributed to other taxing jurisdictions as required. The village manager said the municipality had failed to “distribute those taxes, the way we should have,” and proposed a settlement that would remit the county’s share of past PILOT receipts and provide an ongoing annual reporting and payment process.

The village manager described an accounting of what the village believes it owes and said the proposed county share of the six-year calculation is $57,873.29. He said the village has reached similar settlements with the township and library and is negotiating one with the school district. “We would propose to pay that amount in full along with the guarantee to make our payments moving forward,” he said.

Commissioners asked how the PILOT process and state reporting should work going forward; a county official noted that once the initial reporting to the Michigan State Housing Development Authority (MSHDA) is correct, distributions should recur automatically and local units should be able to record and redistribute payments. The village manager acknowledged program complexity and said the state had been willing to accept multi-year payment plans for the village.

A motion to accept the settlement framework passed by voice vote and commissioners directed staff to place the formal settlement on the Nov. 25 meeting consent calendar for final approval and signature. The village manager said he would return if needed to answer follow-up questions.

What this means: The settlement is intended to make taxing jurisdictions whole for previously missed PILOT distributions without litigation. County officials said the amounts owed to any individual jurisdiction are relatively small compared with the administrative and legal costs of pursuing the matter in court, and that the proposed approach provides closure and a commitment to improved annual reporting.

Next steps: The board will consider final settlement documents and any related agreements at its Nov. 25 meeting and, if approved, will instruct the county treasurer’s office on receipt and distribution of the funds.

Village staff told the board that prior PILOT receipts had not been distributed to other taxing jurisdictions as required. The village manager said the municipality had failed to “distribute those taxes, the way we should have,” and proposed a settlement that would remit the county’s share of past PILOT receipts and provide an ongoing annual reporting and payment process.

The village manager described an accounting of what the village believes it owes and said the proposed county share of the six-year calculation is $57,873.29. He said the village has reached similar settlements with the township and library and is negotiating one with the school district. “We would propose to pay that amount in full along with the guarantee to make our payments moving forward,” he said.

Commissioners asked how the PILOT process and state reporting should work going forward; a county official noted that once the initial reporting to the Michigan State Housing Development Authority (MSHDA) is correct, distributions should recur automatically and local units should be able to record and redistribute payments. The village manager acknowledged program complexity and said the state had been willing to accept multi-year payment plans for the village.

A motion to accept the settlement framework passed by voice vote and commissioners directed staff to place the formal settlement on the Nov. 25 meeting consent calendar for final approval and signature. The village manager said he would return if needed to answer follow-up questions.

What this means: The settlement is intended to make taxing jurisdictions whole for previously missed PILOT distributions without litigation. County officials said the amounts owed to any individual jurisdiction are relatively small compared with the administrative and legal costs of pursuing the matter in court, and that the proposed approach provides closure and a commitment to improved annual reporting.

Next steps: The board will consider final settlement documents and any related agreements at its Nov. 25 meeting and, if approved, will instruct the county treasurer’s office on receipt and distribution of the funds.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee