Brentwood subcommittee recommends 100/80/80 insurance split, asks Select Board to consider deductible offsets

November 13, 2025 | Brentwood Town, Rockingham County, New Hampshire

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

The Brentwood Town Health Insurance Subcommittee voted to recommend the Select Board change how the town pays for employee health coverage, proposing a 100% employer contribution for single plans and 80% for couple and family plans (commonly described in the meeting as "100/80/80"). Speaker 5 moved the recommendation, saying, "I'm gonna make a motion right now that we go with the $180.80," and the committee approved the motion by verbal vote.

Why it matters: Committee members said the recommendation aims to align the employee handbook baseline ($175.75) with current plan pricing, make contribution splits more consistent with neighboring towns and reduce future budget shocks. Members also emphasized that correcting an apparent mismatch between previously published rates and 2025 insurance quotes produced large year-to-year changes in employee out-of-pocket costs.

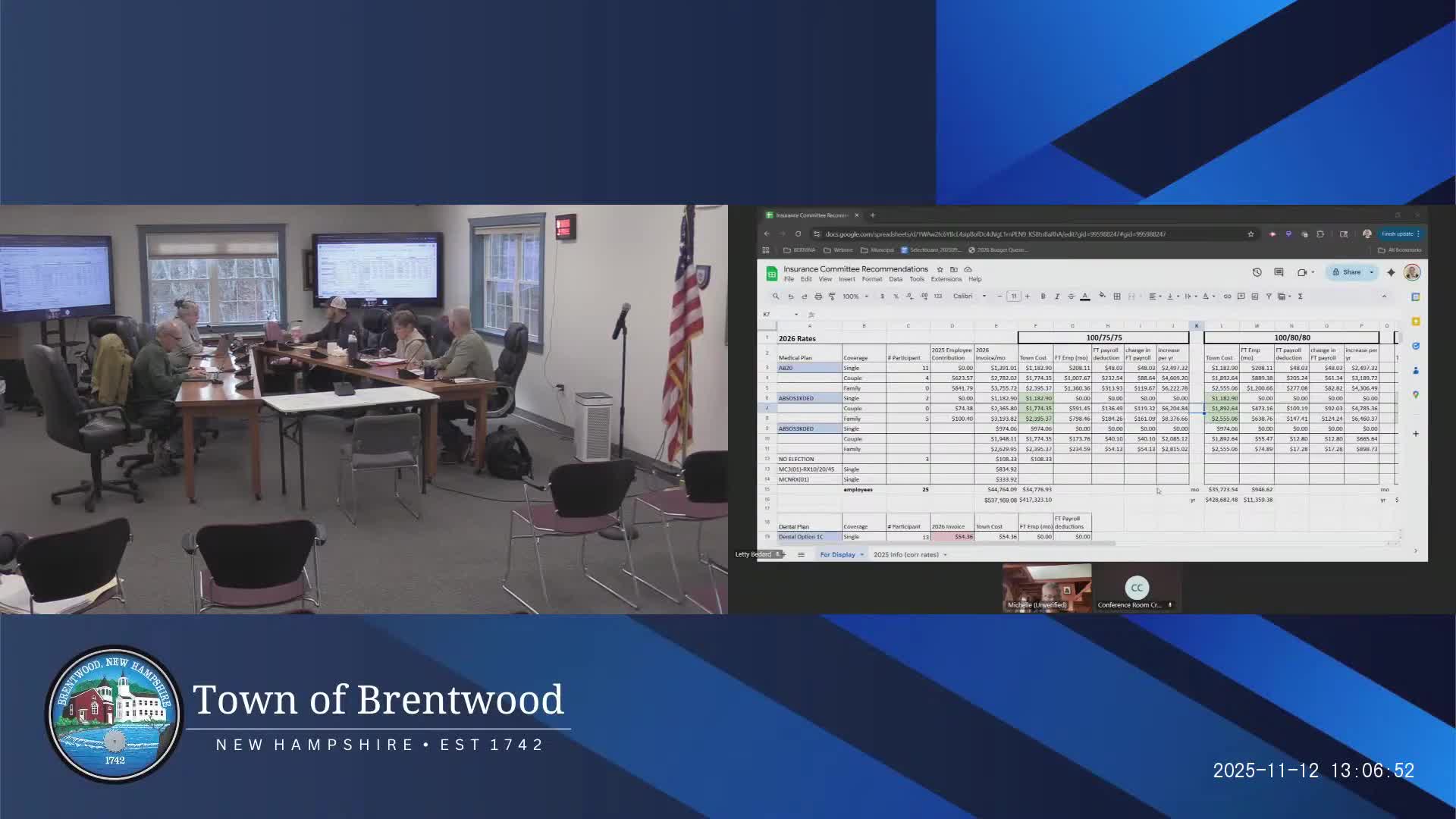

What the committee debated: Members worked through a new spreadsheet showing per-paycheck and annual impacts. Speaker 2 explained the spreadsheet column that illustrated projected increases for a typical family plan and added annualized town- and employee-cost columns so the Select Board could see both sides: "This is what the invoice cost would be for the current election, per month for the employees that we have that take it," Speaker 2 said during the presentation.

Several members argued the sudden increase reflected two separate problems: (1) an apparent clerical or rate-entry discrepancy between 2024 and 2025 rates and (2) prior Select Board choices that had retained older contribution splits despite changing available plans. Speaker 6 characterized the financial impact at one point as large: "the town lost $96,000 just in one year if the book was followed," reflecting the committee's concern about misaligned bookkeeping and plan design.

Deductible offsets and implementation questions: The committee unanimously asked the Select Board to consider ways to offset higher deductibles that would fall on employees if they move to lower‑premium, higher‑deductible plans. Members discussed possible structures including a limited HRA/HSA or a direct annual reimbursement—for example, $500 toward a couple deductible and $1,000 toward a family deductible—while noting HealthTrust rules may limit employer contributions (speakers cited a reported 50% cap from HealthTrust). The committee resolved to confirm allowable contribution mechanisms with the town's HealthTrust representative before the Select Board takes final action.

Formal actions and next steps: The subcommittee voted to forward the spreadsheet and a recommendation for 100/80/80 to the Select Board and separately voted to ask the Select Board to consider an annual deductible contribution or an HRA/HSA as a possible offset. Members asked staff to send the detailed spreadsheet to the Select Board and to clarify HealthTrust constraints on deductible contributions. The committee adjourned after scheduling those follow-ups.

Attribution note: All quotes and numerical examples in this article are drawn from committee members' remarks during the recorded subcommittee meeting; speakers are identified by their participant labels in the meeting record because the transcript does not attach full legal names to each speaker label. The Select Board will make any binding changes; the subcommittee made recommendations only.

Why it matters: Committee members said the recommendation aims to align the employee handbook baseline ($175.75) with current plan pricing, make contribution splits more consistent with neighboring towns and reduce future budget shocks. Members also emphasized that correcting an apparent mismatch between previously published rates and 2025 insurance quotes produced large year-to-year changes in employee out-of-pocket costs.

What the committee debated: Members worked through a new spreadsheet showing per-paycheck and annual impacts. Speaker 2 explained the spreadsheet column that illustrated projected increases for a typical family plan and added annualized town- and employee-cost columns so the Select Board could see both sides: "This is what the invoice cost would be for the current election, per month for the employees that we have that take it," Speaker 2 said during the presentation.

Several members argued the sudden increase reflected two separate problems: (1) an apparent clerical or rate-entry discrepancy between 2024 and 2025 rates and (2) prior Select Board choices that had retained older contribution splits despite changing available plans. Speaker 6 characterized the financial impact at one point as large: "the town lost $96,000 just in one year if the book was followed," reflecting the committee's concern about misaligned bookkeeping and plan design.

Deductible offsets and implementation questions: The committee unanimously asked the Select Board to consider ways to offset higher deductibles that would fall on employees if they move to lower‑premium, higher‑deductible plans. Members discussed possible structures including a limited HRA/HSA or a direct annual reimbursement—for example, $500 toward a couple deductible and $1,000 toward a family deductible—while noting HealthTrust rules may limit employer contributions (speakers cited a reported 50% cap from HealthTrust). The committee resolved to confirm allowable contribution mechanisms with the town's HealthTrust representative before the Select Board takes final action.

Formal actions and next steps: The subcommittee voted to forward the spreadsheet and a recommendation for 100/80/80 to the Select Board and separately voted to ask the Select Board to consider an annual deductible contribution or an HRA/HSA as a possible offset. Members asked staff to send the detailed spreadsheet to the Select Board and to clarify HealthTrust constraints on deductible contributions. The committee adjourned after scheduling those follow-ups.

Attribution note: All quotes and numerical examples in this article are drawn from committee members' remarks during the recorded subcommittee meeting; speakers are identified by their participant labels in the meeting record because the transcript does not attach full legal names to each speaker label. The Select Board will make any binding changes; the subcommittee made recommendations only.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee