Timnath council advances rec-center financing, first readings on budget and sales-tax change

November 12, 2025 | Timnath, Larimer County, Colorado

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Timnath — The Timnath Town Council on Nov. 11 advanced the financing and budget steps needed to build the recreation center voters approved this month, approving first readings and setting public hearings on a package of ordinances that would create a new special revenue fund, adjust the town's sales-tax code and carry the draft 2026 budget to a Dec. 9 vote.

Finance Director Lisa Gagnari told council the draft 2026 budget includes a special revenue fund for the recreation center to hold financing proceeds, the dedicated 1.25-percentage-point sales tax approved by voters, debt service, and early engineering and design costs. The draft projects a 3% growth in sales-tax revenue while adding 4.5 full-time-equivalent positions (two police positions, one parks maintenance worker, one GIS position and one administrative/sergeant slot split across departments as described by staff).

Gagnari also said the town anticipates a possible debt issuance in 2027 of up to $14 million to fund infrastructure work tied to the longer-term capital plan. "We projected minimal growth," she said, noting some building-permit revenue is trending downward while other restricted resources such as impact fees and TDA funds will be used before general-fund dollars.

Council members asked for additional granularity before final adoption, requesting a department-level expenditure breakout (wages, benefits and other object groups) and clearer identification of which capital projects would drive the proposed borrowing. Council also pressed staff to distinguish actual year-end savings versus funds that will be carried forward to 2026.

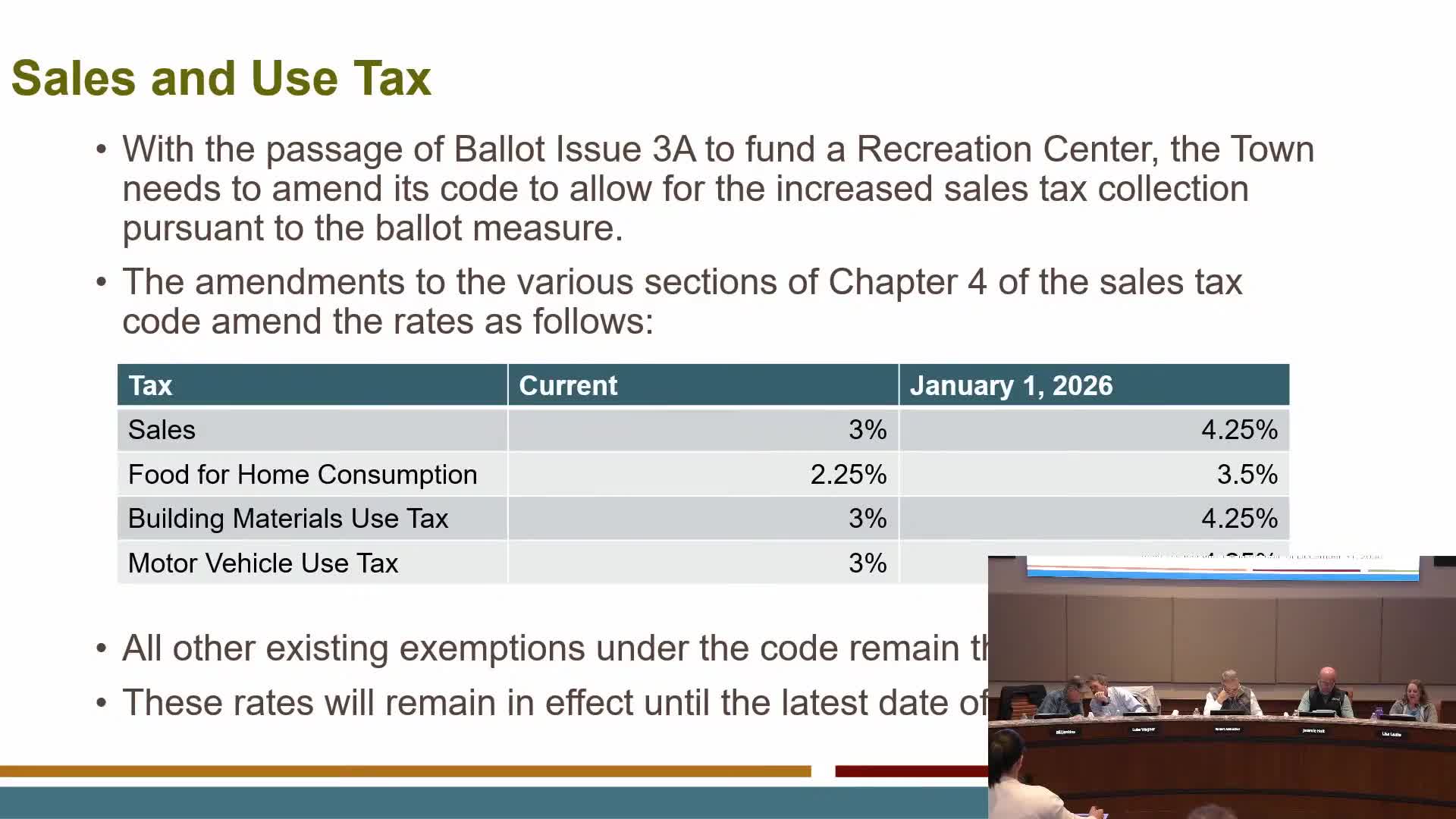

The ordinance adopting the sales-tax code changes to implement the 1.25% voter-approved increase — set to take effect Jan. 1, 2026 — was set for a Dec. 9 public hearing. Council set second readings and public hearings for the budget and related appropriation ordinances for the same Dec. 9 meeting.

Votes at a glance: the council approved first readings and set public hearings for the 2026 budget ordinances and the sales-tax code changes; final adoption is scheduled for Dec. 9, 2025.

Finance Director Lisa Gagnari told council the draft 2026 budget includes a special revenue fund for the recreation center to hold financing proceeds, the dedicated 1.25-percentage-point sales tax approved by voters, debt service, and early engineering and design costs. The draft projects a 3% growth in sales-tax revenue while adding 4.5 full-time-equivalent positions (two police positions, one parks maintenance worker, one GIS position and one administrative/sergeant slot split across departments as described by staff).

Gagnari also said the town anticipates a possible debt issuance in 2027 of up to $14 million to fund infrastructure work tied to the longer-term capital plan. "We projected minimal growth," she said, noting some building-permit revenue is trending downward while other restricted resources such as impact fees and TDA funds will be used before general-fund dollars.

Council members asked for additional granularity before final adoption, requesting a department-level expenditure breakout (wages, benefits and other object groups) and clearer identification of which capital projects would drive the proposed borrowing. Council also pressed staff to distinguish actual year-end savings versus funds that will be carried forward to 2026.

The ordinance adopting the sales-tax code changes to implement the 1.25% voter-approved increase — set to take effect Jan. 1, 2026 — was set for a Dec. 9 public hearing. Council set second readings and public hearings for the budget and related appropriation ordinances for the same Dec. 9 meeting.

Votes at a glance: the council approved first readings and set public hearings for the 2026 budget ordinances and the sales-tax code changes; final adoption is scheduled for Dec. 9, 2025.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee