GIAA seeks short-term credit facility as comptroller flags cash pressure and $9.25M fuel-tax arrear

November 10, 2025 | General Government Operations and Appropriations , Legislative, Guam

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

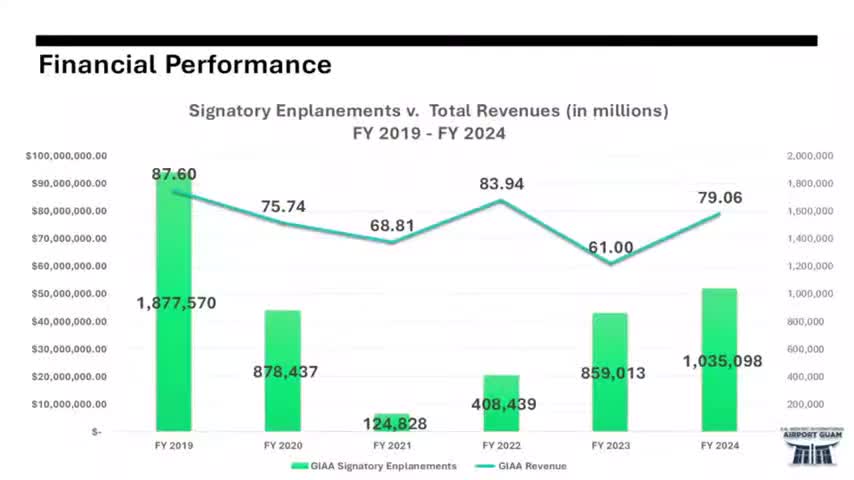

The Guam International Airport Authority presented a financial briefing showing emplanements remain well below pre-pandemic levels and that the airport is using cost controls and cash-management tools to preserve its debt metrics.

Comptroller Daphne Shimizu told the committee that emplanements for FY24 are about 55% of 2019 levels. She said the airport has maintained a debt-service-coverage ratio of approximately 1.69 times (above the 1.25 requirement) and received an unmodified audit opinion for FY24; Moodys rating remained at Ba2 (investment grade equivalent for the territory) but the outlook was revised to negative because of the slow tourism recovery and Typhoon Mawar impacts.

Cash-flow tool: Shimizu and management described an RFP process led by the Guam Economic Development Authority (GEDA) seeking a short-term financing facility up to $15 million (GEDA RFP 25-007). The RFP was awarded by the GEDA board on Oct. 14, 2025; GIAA and GIDA will negotiate terms with the awarded company and then present terms to the GIAA board for approval. GIAA said the facility is intended as a contingent smoothing instrument for FAA-grant reimbursement timing and large capital disbursements; management said it hopes not to use the facility but wants the backup through Sept. 30, 2030.

Aviation fuel-tax arrears: Committee members pressed GIAA on a recognized principal balance of $9,254,000 (01/01/2018 through 09/30/2023) described as aviation fuel-tax funds owed to the airport. Shimizu said discussions are ongoing with the Bureau of Budget Management and Research and the governors office about whether transfer authority or an appropriation will be used to make payments. She said FAA has offered corrective-action options, and that a FAA-approved payment plan would add interest costs on top of the principal; GIAAs estimate of interest under a 5-year payment plan would be approximately $2.3M–$2.4M per year (totaled across payments) compared with an upfront settlement that would avoid that additional interest.

Why it matters: GIAA said its finances remain tightly coupled to emplanements; lower passenger volumes reduce airport-generated revenue and constrain spending on maintenance and match-share requirements for federally funded capital projects. Several senators urged the legislature to consider appropriation options rather than an interest-bearing facility.

Clarifying details: GIAA described a previously expected $5 million insurance claim that has been received; it noted the RFP allows up to $15 million but management expects to draw only what is needed. The airports enabling statute permits certain borrowing for up to five years without separate legislative approval; GEDA and GIAA representatives said they will present negotiated terms to the GIAA board before any drawdown.

Provenance: Financial performance and the short-term facility were introduced at 00:23:23 and the RFP-award status and discussion of the aviation fuel-tax arrear are discussed through 00:33:53.

Comptroller Daphne Shimizu told the committee that emplanements for FY24 are about 55% of 2019 levels. She said the airport has maintained a debt-service-coverage ratio of approximately 1.69 times (above the 1.25 requirement) and received an unmodified audit opinion for FY24; Moodys rating remained at Ba2 (investment grade equivalent for the territory) but the outlook was revised to negative because of the slow tourism recovery and Typhoon Mawar impacts.

Cash-flow tool: Shimizu and management described an RFP process led by the Guam Economic Development Authority (GEDA) seeking a short-term financing facility up to $15 million (GEDA RFP 25-007). The RFP was awarded by the GEDA board on Oct. 14, 2025; GIAA and GIDA will negotiate terms with the awarded company and then present terms to the GIAA board for approval. GIAA said the facility is intended as a contingent smoothing instrument for FAA-grant reimbursement timing and large capital disbursements; management said it hopes not to use the facility but wants the backup through Sept. 30, 2030.

Aviation fuel-tax arrears: Committee members pressed GIAA on a recognized principal balance of $9,254,000 (01/01/2018 through 09/30/2023) described as aviation fuel-tax funds owed to the airport. Shimizu said discussions are ongoing with the Bureau of Budget Management and Research and the governors office about whether transfer authority or an appropriation will be used to make payments. She said FAA has offered corrective-action options, and that a FAA-approved payment plan would add interest costs on top of the principal; GIAAs estimate of interest under a 5-year payment plan would be approximately $2.3M–$2.4M per year (totaled across payments) compared with an upfront settlement that would avoid that additional interest.

Why it matters: GIAA said its finances remain tightly coupled to emplanements; lower passenger volumes reduce airport-generated revenue and constrain spending on maintenance and match-share requirements for federally funded capital projects. Several senators urged the legislature to consider appropriation options rather than an interest-bearing facility.

Clarifying details: GIAA described a previously expected $5 million insurance claim that has been received; it noted the RFP allows up to $15 million but management expects to draw only what is needed. The airports enabling statute permits certain borrowing for up to five years without separate legislative approval; GEDA and GIAA representatives said they will present negotiated terms to the GIAA board before any drawdown.

Provenance: Financial performance and the short-term facility were introduced at 00:23:23 and the RFP-award status and discussion of the aviation fuel-tax arrear are discussed through 00:33:53.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee