Juneau finance staff reports FY25 surplus, assembly directs no broad FY26 service cuts

November 06, 2025 | Juneau City and Borough, Alaska

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

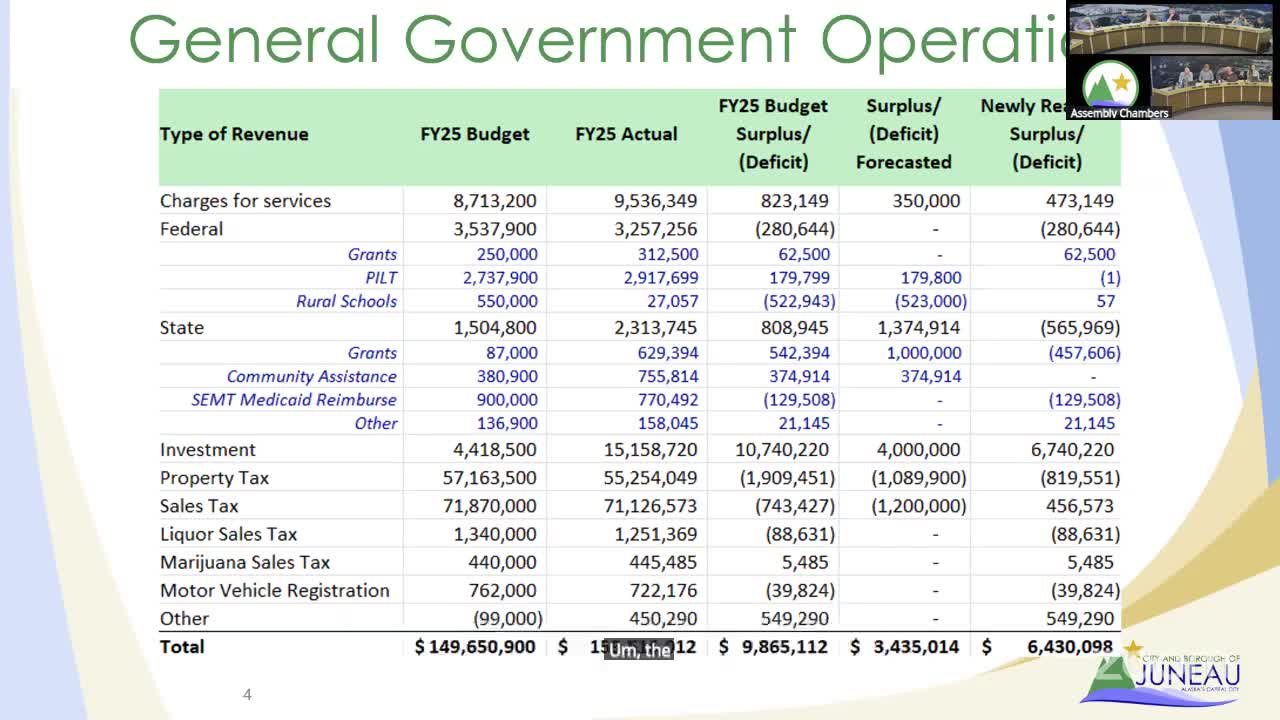

The Juneau City and Borough Finance Director, Miss Flick, told the Assembly Finance Committee on Nov. 5 that FY25 closed with substantially better results than projected, driven by larger-than-expected investment earnings and underspending across departments. "The big number on this page is the investment income, where we had $4,400,000 budgeted. We had $15,000,000 actual," Miss Flick said during the meeting.

The finance presentation showed general-government revenue near $71 million for FY25 and about $11 million in overall expenditure underspending. Personnel savings accounted for roughly $5.2 million of that underspend, and the presentation identified police, fire, transit, community development, finance and streets among departments with larger lapses. The director said year-end close processes and staff retention improved, helping produce timely audit work and more accurate reporting.

Miss Flick told the committee the city’s unrestricted fund balance finished FY25 at about $31.4 million — roughly $11 million higher than staff had expected when building the FY26 budget. After actions already adopted for FY26 and staff’s estimate of the impact from recently approved sales-tax exemptions, staff now projects an FY26 ending unrestricted balance of about $15 million.

Mayor Weldon and other members questioned drivers of the personnel lapses and the presentation’s apples‑to‑oranges percentage comparisons; Miss Flick clarified dollar‑value metrics were the sounder comparison. Manager Kester and Miss Flick recommended using a combination of tools to address the FY27 forecast gap — service reductions, revenue changes, and internal budget assumptions — but urged the assembly not to rush wide operating cuts in FY26.

The assembly carried a motion (with an amendment) directing staff "to not do any broad service reductions or formal operating budget reductions for FY26, but fund FY26 from the unrestricted fund balance," while allowing narrowly targeted reductions tied to new programs or projects and authorizing the manager to exercise managerial discretion on hiring and project starts. That motion passed by consent after amendment and discussion.

The committee asked staff to return with more detailed options and to design a public engagement process to inform FY27 decisions. Miss Flick said initial public data on the sales-tax exemptions will not be available until mid‑May 2026, and urged the committee to use the FY26 balance to buy time for deliberation rather than make immediate, broad cuts.

Looking ahead, staff emphasized there are fixed, recurring pressure points for FY27 (contracted wage increases, ongoing flood‑response costs) that combined with the estimated revenue loss will require sustained action. The finance director closed by noting the city’s improved year‑end processes and the audit questions were routine and manageable.

The finance presentation showed general-government revenue near $71 million for FY25 and about $11 million in overall expenditure underspending. Personnel savings accounted for roughly $5.2 million of that underspend, and the presentation identified police, fire, transit, community development, finance and streets among departments with larger lapses. The director said year-end close processes and staff retention improved, helping produce timely audit work and more accurate reporting.

Miss Flick told the committee the city’s unrestricted fund balance finished FY25 at about $31.4 million — roughly $11 million higher than staff had expected when building the FY26 budget. After actions already adopted for FY26 and staff’s estimate of the impact from recently approved sales-tax exemptions, staff now projects an FY26 ending unrestricted balance of about $15 million.

Mayor Weldon and other members questioned drivers of the personnel lapses and the presentation’s apples‑to‑oranges percentage comparisons; Miss Flick clarified dollar‑value metrics were the sounder comparison. Manager Kester and Miss Flick recommended using a combination of tools to address the FY27 forecast gap — service reductions, revenue changes, and internal budget assumptions — but urged the assembly not to rush wide operating cuts in FY26.

The assembly carried a motion (with an amendment) directing staff "to not do any broad service reductions or formal operating budget reductions for FY26, but fund FY26 from the unrestricted fund balance," while allowing narrowly targeted reductions tied to new programs or projects and authorizing the manager to exercise managerial discretion on hiring and project starts. That motion passed by consent after amendment and discussion.

The committee asked staff to return with more detailed options and to design a public engagement process to inform FY27 decisions. Miss Flick said initial public data on the sales-tax exemptions will not be available until mid‑May 2026, and urged the committee to use the FY26 balance to buy time for deliberation rather than make immediate, broad cuts.

Looking ahead, staff emphasized there are fixed, recurring pressure points for FY27 (contracted wage increases, ongoing flood‑response costs) that combined with the estimated revenue loss will require sustained action. The finance director closed by noting the city’s improved year‑end processes and the audit questions were routine and manageable.

Don't Miss a Word: See the Full Meeting!

Go beyond summaries. Unlock every video, transcript, and key insight with a Founder Membership.

✓

Get instant access to full meeting videos

✓

Search and clip any phrase from complete transcripts

✓

Receive AI-powered summaries & custom alerts

✓

Enjoy lifetime, unrestricted access to government data

30-day money-back guarantee