Brigham City staff outline $24M peaking plant financing, timeline and operations plan

October 03, 2025 | Brigham City Council, Brigham City, Box Elder County, Utah

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

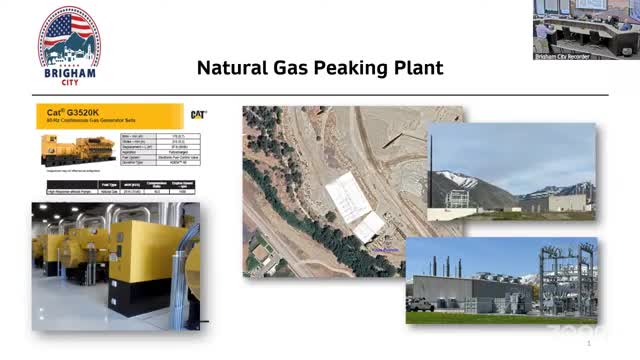

Public Power Director Tom Cooper briefed the council on Oct. 2 about a planned natural-gas peaking plant the city will operate to reduce exposure to volatile wholesale power prices.

Cooper said the facility will be owned and financed by the Utah Associated Municipal Power Systems (UAMPS). Under the agreement described to the council, UAMPS will bond for construction and Brigham City will operate and maintain the plant; the city will make debt payments to UAMPS through its regular monthly billing until the bond is repaid, at which point ownership will transfer to Brigham City.

Cooper told the council the direct-placement bond is for $24 million with a 20-year term and a market rate the presenters said was about 3.99 percent. The bond includes a call feature that KeyBank will exercise in year 10; Cooper said the structure also allows the city to refinance after one year without penalty if market conditions permit. Staff estimated Brigham City’s annual payment on the debt at about $1.8 million (presenter-provided approximation).

Cooper and staff said the vendor selected through UAMPS’s procurement process is Wheeler Machinery; construction was described as likely to begin quickly, with “moving dirt” expected within 30–60 days and an operational target within roughly 18 months, subject to seasonal and market conditions.

Council members and staff discussed the plant’s role as a hedge: the city will decide when to dispatch the units to meet local peaks, and the goal is to avoid extremely high market prices at times of peak demand. Staff referred to past periods when short-term prices spiked and said local generation can reduce exposure to those events. Tom Cooper and other staff offered to provide additional historical and projected price scenarios to the council on request.

No formal council action was taken on the peaking plant during the meeting; staff presented the financing details and operational model and answered questions.

Cooper said the facility will be owned and financed by the Utah Associated Municipal Power Systems (UAMPS). Under the agreement described to the council, UAMPS will bond for construction and Brigham City will operate and maintain the plant; the city will make debt payments to UAMPS through its regular monthly billing until the bond is repaid, at which point ownership will transfer to Brigham City.

Cooper told the council the direct-placement bond is for $24 million with a 20-year term and a market rate the presenters said was about 3.99 percent. The bond includes a call feature that KeyBank will exercise in year 10; Cooper said the structure also allows the city to refinance after one year without penalty if market conditions permit. Staff estimated Brigham City’s annual payment on the debt at about $1.8 million (presenter-provided approximation).

Cooper and staff said the vendor selected through UAMPS’s procurement process is Wheeler Machinery; construction was described as likely to begin quickly, with “moving dirt” expected within 30–60 days and an operational target within roughly 18 months, subject to seasonal and market conditions.

Council members and staff discussed the plant’s role as a hedge: the city will decide when to dispatch the units to meet local peaks, and the goal is to avoid extremely high market prices at times of peak demand. Staff referred to past periods when short-term prices spiked and said local generation can reduce exposure to those events. Tom Cooper and other staff offered to provide additional historical and projected price scenarios to the council on request.

No formal council action was taken on the peaking plant during the meeting; staff presented the financing details and operational model and answered questions.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting