City reports lower bond borrowing cost; commercial-paper bank to be replaced after state certifications issue

October 07, 2025 | Houston, Harris County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

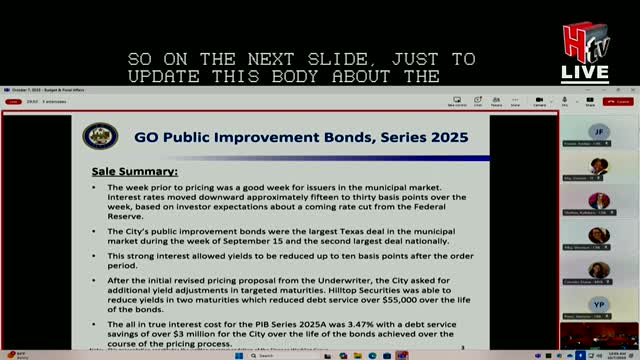

Houston — Controller's office staff and the finance working group told the Budget and Fiscal Affairs Committee on Oct. 20 that the city priced a public-improvement bond sale Sept. 15 with a true interest cost of 3.47% and will recommend replacing the bank backing a $125 million commercial paper line after Barclays said it could not provide state-required certifications.

The finance working group representative said the Sept. 15 transaction drew strong investor demand and allowed the city to lower interest costs during the order period and to negotiate an additional $55,000 in savings. "All in, the true interest cost of the bond transaction was 3.47%, and represented a savings of debt service of approximately $3,000,000 over the life of the bonds," the presenter said.

Will Jones of the controller's office summarized monthly financials and noted the city's practice to limit variable‑rate debt exposure in line with rating‑agency guidance. Jones presented the period ending Aug. 31 projections for enterprise and general funds and answered technical questions from the committee.

On the commercial paper line, the finance working group said the city's $125 million facility, currently provided by Barclays, is expiring in November. The group recommended Bank of America for a three‑year replacement facility and will bring a recommendation to council for approval at a hearing tomorrow.

When asked why Barclays is being replaced, the finance working group representative told the committee: "Barclays has indicated that they're unable to provide these certifications, and so they're no longer able to enter into new agreements or renew agreements in the state of Texas." He attributed Barclays' position to state laws discussed in recent legislative sessions (cited in the meeting as Senate Bill 13 and Senate Bill 19). The presenter also said pricing from Bank of America was about seven basis points lower than the city's existing provider.

Committee members asked about the city's overall debt posture and future bond elections. The finance representative said the city expects to layer additional debt as capital projects proceed but is in compliance with its local financial policy limiting debt service as a share of revenues.

The committee did not take a final vote on either the bond transaction (which already closed) or the commercial-paper replacement; those are scheduled for subsequent council action. The finance working group said it will provide full transaction details, including the formal recommendation and terms, at tomorrow's council agenda item.

Provenance: The presentation of the bond sale and costs and the explanation about Barclays' inability to provide certifications appear in committee comments summarizing the Sept. 15 sale and later in the discussion of the commercial paper replacement.

The finance working group representative said the Sept. 15 transaction drew strong investor demand and allowed the city to lower interest costs during the order period and to negotiate an additional $55,000 in savings. "All in, the true interest cost of the bond transaction was 3.47%, and represented a savings of debt service of approximately $3,000,000 over the life of the bonds," the presenter said.

Will Jones of the controller's office summarized monthly financials and noted the city's practice to limit variable‑rate debt exposure in line with rating‑agency guidance. Jones presented the period ending Aug. 31 projections for enterprise and general funds and answered technical questions from the committee.

On the commercial paper line, the finance working group said the city's $125 million facility, currently provided by Barclays, is expiring in November. The group recommended Bank of America for a three‑year replacement facility and will bring a recommendation to council for approval at a hearing tomorrow.

When asked why Barclays is being replaced, the finance working group representative told the committee: "Barclays has indicated that they're unable to provide these certifications, and so they're no longer able to enter into new agreements or renew agreements in the state of Texas." He attributed Barclays' position to state laws discussed in recent legislative sessions (cited in the meeting as Senate Bill 13 and Senate Bill 19). The presenter also said pricing from Bank of America was about seven basis points lower than the city's existing provider.

Committee members asked about the city's overall debt posture and future bond elections. The finance representative said the city expects to layer additional debt as capital projects proceed but is in compliance with its local financial policy limiting debt service as a share of revenues.

The committee did not take a final vote on either the bond transaction (which already closed) or the commercial-paper replacement; those are scheduled for subsequent council action. The finance working group said it will provide full transaction details, including the formal recommendation and terms, at tomorrow's council agenda item.

Provenance: The presentation of the bond sale and costs and the explanation about Barclays' inability to provide certifications appear in committee comments summarizing the Sept. 15 sale and later in the discussion of the commercial paper replacement.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting