Lorain County commissioners explain doubling homestead credits as partial rollback of recent unvoted property tax increases

October 11, 2025 | Lorain County, Ohio

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Commissioner Moore told the Board of Lorain County Commissioners on Oct. 10 that the board used a limited statutory window to increase homestead/owner‑occupied credits, a move he said reduces part of the unvoted property tax increases that occurred after 2023 revaluations.

Why it matters: commissioners said the change provides immediate relief to owner‑occupied homeowners and seniors who were most affected by large revaluation‑related increases. The change also shifts some of the near‑term distribution of property tax dollars between county and other taxing districts, prompting concern and questions from local school officials.

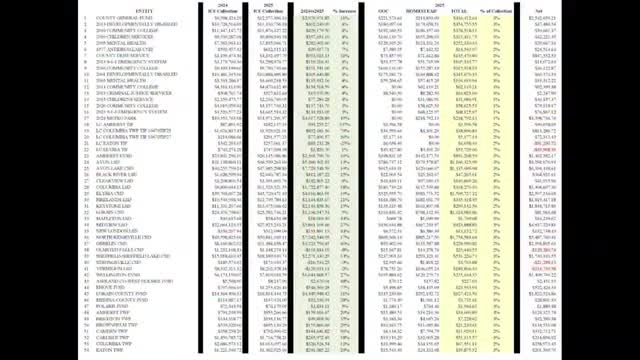

Details presented by the commissioners and staff include: countywide property tax collections shown on a slide rose from about $510,000,000 to $587,000,000 (a roughly 15% increase) after recent revaluations. Commissioners said they used statutory authority to double the allowable exemption (the county said the state permitted a doubling in June), which they described as reducing the excessive unvoted increase by about $59,000,000 overall and yielding roughly $17,400,000 in reduced tax impact for homeowners countywide.

Commissioners said the relief is not limited to seniors: owner‑occupied homes generally receive a credit, and seniors, veterans with disability, the handicapped and certain widows/widowers may qualify. Commissioners urged eligible residents to apply for the homestead exemption before Dec. 31 to receive the benefit for 2026 and noted roughly 19,550 households currently have the homestead exemption on record in the county.

Commissioners acknowledged the relief does not resolve underlying state‑level issues. They said two earlier state laws (one from the 1970s and one from the 1990s) and court rulings left Ohio’s school funding structure vulnerable to large shifts when property values change; they urged local and state officials to pursue longer‑term fixes. Several commissioners also warned that proposals to replace property tax with a higher sales tax would shift control of local funding to Columbus and could create cross‑border tax issues.

Some local school officials and superintendents contacted commissioners to say the unexpected additional receipts had disrupted multi‑year budgets; commissioners said they expected conversations with school boards to continue as districts adapt their five‑year forecasts.

Ending: Commissioners said the action taken earlier this week was a targeted, temporary measure to provide relief and that additional legislative or structural changes at the state level are necessary to prevent similar spikes in the future.

Why it matters: commissioners said the change provides immediate relief to owner‑occupied homeowners and seniors who were most affected by large revaluation‑related increases. The change also shifts some of the near‑term distribution of property tax dollars between county and other taxing districts, prompting concern and questions from local school officials.

Details presented by the commissioners and staff include: countywide property tax collections shown on a slide rose from about $510,000,000 to $587,000,000 (a roughly 15% increase) after recent revaluations. Commissioners said they used statutory authority to double the allowable exemption (the county said the state permitted a doubling in June), which they described as reducing the excessive unvoted increase by about $59,000,000 overall and yielding roughly $17,400,000 in reduced tax impact for homeowners countywide.

Commissioners said the relief is not limited to seniors: owner‑occupied homes generally receive a credit, and seniors, veterans with disability, the handicapped and certain widows/widowers may qualify. Commissioners urged eligible residents to apply for the homestead exemption before Dec. 31 to receive the benefit for 2026 and noted roughly 19,550 households currently have the homestead exemption on record in the county.

Commissioners acknowledged the relief does not resolve underlying state‑level issues. They said two earlier state laws (one from the 1970s and one from the 1990s) and court rulings left Ohio’s school funding structure vulnerable to large shifts when property values change; they urged local and state officials to pursue longer‑term fixes. Several commissioners also warned that proposals to replace property tax with a higher sales tax would shift control of local funding to Columbus and could create cross‑border tax issues.

Some local school officials and superintendents contacted commissioners to say the unexpected additional receipts had disrupted multi‑year budgets; commissioners said they expected conversations with school boards to continue as districts adapt their five‑year forecasts.

Ending: Commissioners said the action taken earlier this week was a targeted, temporary measure to provide relief and that additional legislative or structural changes at the state level are necessary to prevent similar spikes in the future.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting