NVTA investment portfolio outperforms short‑term benchmarks; staff stresses conservative approach and headline risk management

October 10, 2025 | Northern Virginia Transportation Authority, Boards and Commissions, Executive, Virginia

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Northern Virginia Transportation Authority staff told the finance committee on Oct. 9 that the authority's investment portfolio produced returns large enough to cover the authority's annual operating budget in a single month and explained the portfolio strategy, benchmarks and risk controls.

During the financial overview staff said the monthly investment return was sufficient to fund the year's operating budget plus $2,000,000. "In 1 month, the investment portfolio is paying the entire year's operating budget plus $2,000,000," staff said.

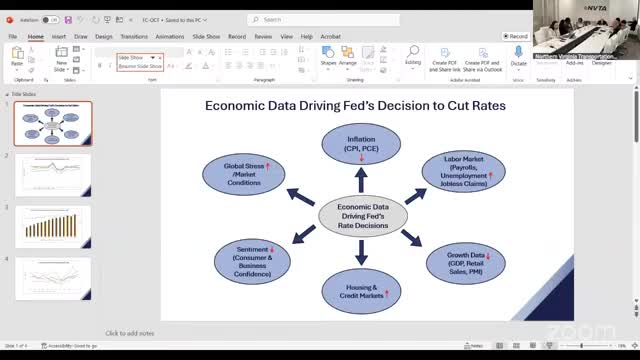

Investment staff presented a framework of economic indicators the Federal Reserve considers when deciding rate cuts (inflation, labor market, growth data, housing and credit markets, sentiment, and global stress) and noted that current uncertainty is one reason the authority is timing its PAYGo revenue estimates later in the cycle. "These are not the only factors because there could be other factors," said Deb, the investments presenter, while explaining that political developments can also affect data releases.

Staff described benchmark selection: the Virginia Local Government Investment Pool (LGIP) extended maturity pool (reported in materials at 3.87%), and an ICE/Bank of America 1–3 year index (18‑month average used) for the portion of the portfolio with longer maturities. Staff said those benchmarks were selected after committee consultation to reflect the portfolio's multi‑year horizon while preserving liquidity for large, occasional reimbursement requests.

Staff also said they avoid headline and concentration risks. They explained that many agency securities the authority holds are issued by the Federal Home Loan Bank system (not the subject of recent IPO discussion) and that staff are monitoring proposals concerning Fannie Mae and Freddie Mac. They said they would avoid certain foreign exposures and would forgo purchases that create headline risk even if securities are legally permissible.

"By positioning and structuring the portfolio the way we have, as rates go down, our return will decline slower. As rates go up again, we're in position to grab the new rates quicker," staff said, describing the reinvestment ladder strategy the authority uses to manage interest‑rate movement. Staff emphasized the portfolio is managed to preserve liquidity and comply with the authority's investment policy.

Materials showed the investment portfolio outperforming the selected benchmarks over the recent period. Staff said they continue to review peer pools and state offerings when appropriate and will report to the committee regularly.

During the financial overview staff said the monthly investment return was sufficient to fund the year's operating budget plus $2,000,000. "In 1 month, the investment portfolio is paying the entire year's operating budget plus $2,000,000," staff said.

Investment staff presented a framework of economic indicators the Federal Reserve considers when deciding rate cuts (inflation, labor market, growth data, housing and credit markets, sentiment, and global stress) and noted that current uncertainty is one reason the authority is timing its PAYGo revenue estimates later in the cycle. "These are not the only factors because there could be other factors," said Deb, the investments presenter, while explaining that political developments can also affect data releases.

Staff described benchmark selection: the Virginia Local Government Investment Pool (LGIP) extended maturity pool (reported in materials at 3.87%), and an ICE/Bank of America 1–3 year index (18‑month average used) for the portion of the portfolio with longer maturities. Staff said those benchmarks were selected after committee consultation to reflect the portfolio's multi‑year horizon while preserving liquidity for large, occasional reimbursement requests.

Staff also said they avoid headline and concentration risks. They explained that many agency securities the authority holds are issued by the Federal Home Loan Bank system (not the subject of recent IPO discussion) and that staff are monitoring proposals concerning Fannie Mae and Freddie Mac. They said they would avoid certain foreign exposures and would forgo purchases that create headline risk even if securities are legally permissible.

"By positioning and structuring the portfolio the way we have, as rates go down, our return will decline slower. As rates go up again, we're in position to grab the new rates quicker," staff said, describing the reinvestment ladder strategy the authority uses to manage interest‑rate movement. Staff emphasized the portfolio is managed to preserve liquidity and comply with the authority's investment policy.

Materials showed the investment portfolio outperforming the selected benchmarks over the recent period. Staff said they continue to review peer pools and state offerings when appropriate and will report to the committee regularly.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting