Adams County presents balanced 2026 budget with modest levy increase and lower mill rate

October 04, 2025 | Adams County, Wisconsin

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Kyle, the finance director, presented the county's proposed 2026 budget and described the timeline and major assumptions used to prepare department requests and the recommended countywide totals.

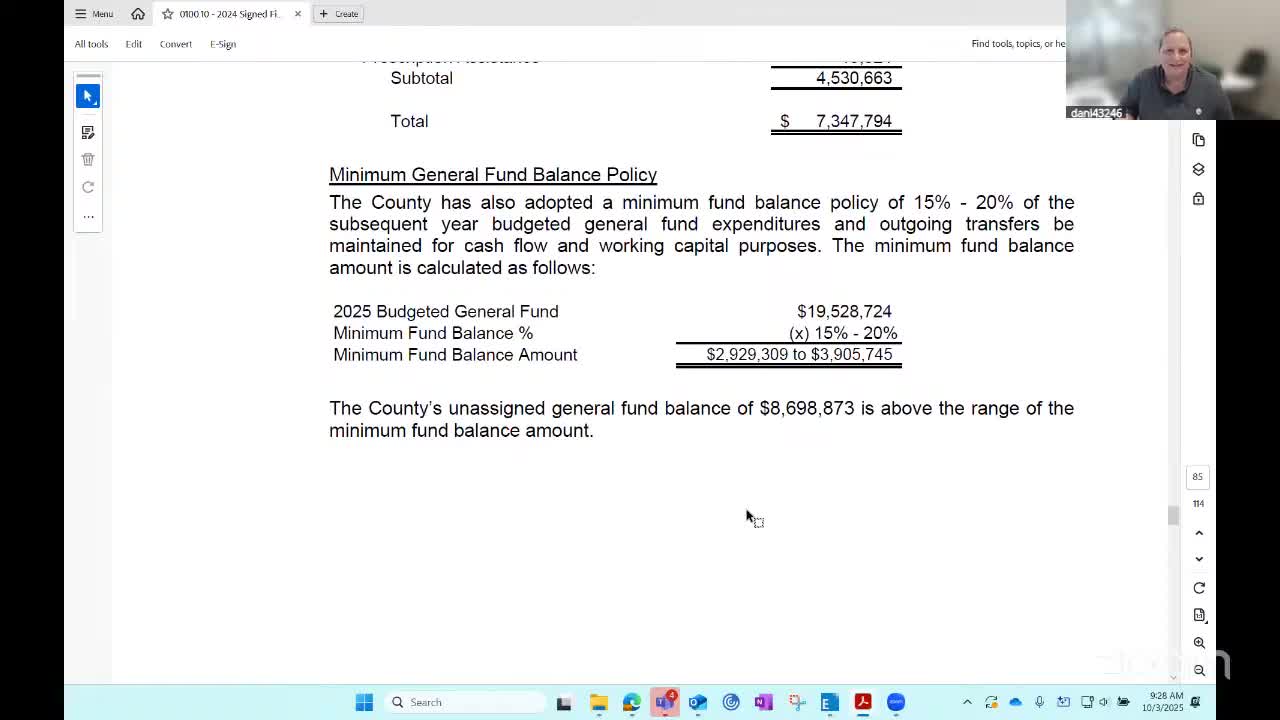

Kyle said the recommended county tax levy (excluding adjustments for library, local road-and-bridge aid and debt service) is $19,999,566 — an increase of roughly $590,000 driven by net new construction — and the county's total levy is $21,138,418, an increase of $355,839. Kyle said the proposed countywide mill rate is $3.88 per $1,000 of equalized value, a decrease of about 73 cents per $1,000 from the prior year. Net new construction for the county was shown as 2.941%.

Key budget assumptions highlighted by Kyle included a 2.4% cost-of-living adjustment (COLA) applied to the salary schedule (tied to the April Midwest CPI), health-insurance premium increases of about 9.5%, and small changes in Wisconsin Retirement System contribution rates (7.2% for general employees, 14.7% for protective employees as cited in the presentation). Total wages and benefits countywide rose in the proposed budget from $24,148,799.79 to $24,832,919.27, an increase of roughly $684,000.

Budget and department highlights provided during the presentation included:

- Sheriff's office: wages and benefits budgeted to increase by about $200,000 year over year.

- Health and Human Services: wages and benefits budgeted to increase by roughly $317,000; about $93,000 of that was budgeted for a case manager position at Practical Sense.

- Planning and Zoning: an increase of about $75,000 to move a code-enforcement officer from part time to full time (the move must still be fully justified to the board).

- Treasurer's office: a decrease of about $102,000 in wages and benefits compared with 2025, reflecting earlier board action to reduce an earlier staffing request.

Kyle said capital projects across the county total roughly $5 million for 2026 and noted some prominent items: replacement or repairs of facility roofs, airport taxiway reconstruction (budgeted again after a 2025 delay while awaiting Bureau of Aeronautics funding), replacement of IT infrastructure, parks equipment rotation, and highway projects (County Highway Z, County Highway D and nearly 11 miles of seal coating). Kyle said capital projects would be funded from a mix of general-fund reserves, debt-service fund balance and existing capital fund balances.

The county clerk's office will receive a one-time $250,000 infusion in the proposed budget to begin replacing voting equipment across municipalities; Kyle and the county clerk said this is a planned 10-year replacement cycle and municipalities remain responsible for maintenance and licensing. On IT, a figure of $2,250,000 was discussed in the meeting as a multi-year replacement plan for core servers (presented as a 5-year replacement cycle by an IT representative), though earlier slides referenced a smaller server estimate; staff said the capital plan worksheets at the back of the budget book will show final project estimates.

The presentation included discussion of fleet management. County staff recommended returning to a five-year replacement cycle (or 75,000 miles) for fleet vehicles after a multi-year experiment with two-year rotations and resale. Kyle and fleet management staff said auction market conditions and lower government purchase discounts have reduced the financial upside of very short replacement cycles; the proposed capital plan reflects a five-year standard with department-level discretion for exceptional units.

The treasurer, Kara, requested reconsideration of additional part-time staffing to handle delinquent-tax workload and foreclosure follow-up. Kara said last year's staffing and benefit underruns left a portion of budgeted funds available and asked the committee to use those savings to fund a part-time, flexible position for peak collection times. Kyle and the human-resources director explained budget treatment of vacant positions and that the county had included some on-call funding; committee members debated whether to reallocate prior-year savings for personnel versus capital purposes. No committee action was taken on that staffing request during the meeting; the treasurer said she will continue to discuss options with staff.

The finance director said the county will present the budget to the full county board in November for adoption and complete required apportionment worksheets (due Nov. 15) allocating the levy across municipalities.

Ending: Finance staff said the complete budget book would be distributed electronically before the county board meeting; board members and the public were invited to review capital project worksheets and to bring departmental questions to staff ahead of the November adoption vote.

Kyle said the recommended county tax levy (excluding adjustments for library, local road-and-bridge aid and debt service) is $19,999,566 — an increase of roughly $590,000 driven by net new construction — and the county's total levy is $21,138,418, an increase of $355,839. Kyle said the proposed countywide mill rate is $3.88 per $1,000 of equalized value, a decrease of about 73 cents per $1,000 from the prior year. Net new construction for the county was shown as 2.941%.

Key budget assumptions highlighted by Kyle included a 2.4% cost-of-living adjustment (COLA) applied to the salary schedule (tied to the April Midwest CPI), health-insurance premium increases of about 9.5%, and small changes in Wisconsin Retirement System contribution rates (7.2% for general employees, 14.7% for protective employees as cited in the presentation). Total wages and benefits countywide rose in the proposed budget from $24,148,799.79 to $24,832,919.27, an increase of roughly $684,000.

Budget and department highlights provided during the presentation included:

- Sheriff's office: wages and benefits budgeted to increase by about $200,000 year over year.

- Health and Human Services: wages and benefits budgeted to increase by roughly $317,000; about $93,000 of that was budgeted for a case manager position at Practical Sense.

- Planning and Zoning: an increase of about $75,000 to move a code-enforcement officer from part time to full time (the move must still be fully justified to the board).

- Treasurer's office: a decrease of about $102,000 in wages and benefits compared with 2025, reflecting earlier board action to reduce an earlier staffing request.

Kyle said capital projects across the county total roughly $5 million for 2026 and noted some prominent items: replacement or repairs of facility roofs, airport taxiway reconstruction (budgeted again after a 2025 delay while awaiting Bureau of Aeronautics funding), replacement of IT infrastructure, parks equipment rotation, and highway projects (County Highway Z, County Highway D and nearly 11 miles of seal coating). Kyle said capital projects would be funded from a mix of general-fund reserves, debt-service fund balance and existing capital fund balances.

The county clerk's office will receive a one-time $250,000 infusion in the proposed budget to begin replacing voting equipment across municipalities; Kyle and the county clerk said this is a planned 10-year replacement cycle and municipalities remain responsible for maintenance and licensing. On IT, a figure of $2,250,000 was discussed in the meeting as a multi-year replacement plan for core servers (presented as a 5-year replacement cycle by an IT representative), though earlier slides referenced a smaller server estimate; staff said the capital plan worksheets at the back of the budget book will show final project estimates.

The presentation included discussion of fleet management. County staff recommended returning to a five-year replacement cycle (or 75,000 miles) for fleet vehicles after a multi-year experiment with two-year rotations and resale. Kyle and fleet management staff said auction market conditions and lower government purchase discounts have reduced the financial upside of very short replacement cycles; the proposed capital plan reflects a five-year standard with department-level discretion for exceptional units.

The treasurer, Kara, requested reconsideration of additional part-time staffing to handle delinquent-tax workload and foreclosure follow-up. Kara said last year's staffing and benefit underruns left a portion of budgeted funds available and asked the committee to use those savings to fund a part-time, flexible position for peak collection times. Kyle and the human-resources director explained budget treatment of vacant positions and that the county had included some on-call funding; committee members debated whether to reallocate prior-year savings for personnel versus capital purposes. No committee action was taken on that staffing request during the meeting; the treasurer said she will continue to discuss options with staff.

The finance director said the county will present the budget to the full county board in November for adoption and complete required apportionment worksheets (due Nov. 15) allocating the levy across municipalities.

Ending: Finance staff said the complete budget book would be distributed electronically before the county board meeting; board members and the public were invited to review capital project worksheets and to bring departmental questions to staff ahead of the November adoption vote.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting