Michigan Eliminates Business Tax to Create Fair Economic Environment

September 05, 2025 | 2025 House Legislature MI, Michigan

Thanks to Scribe from Workplace AI , all articles about Michigan are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

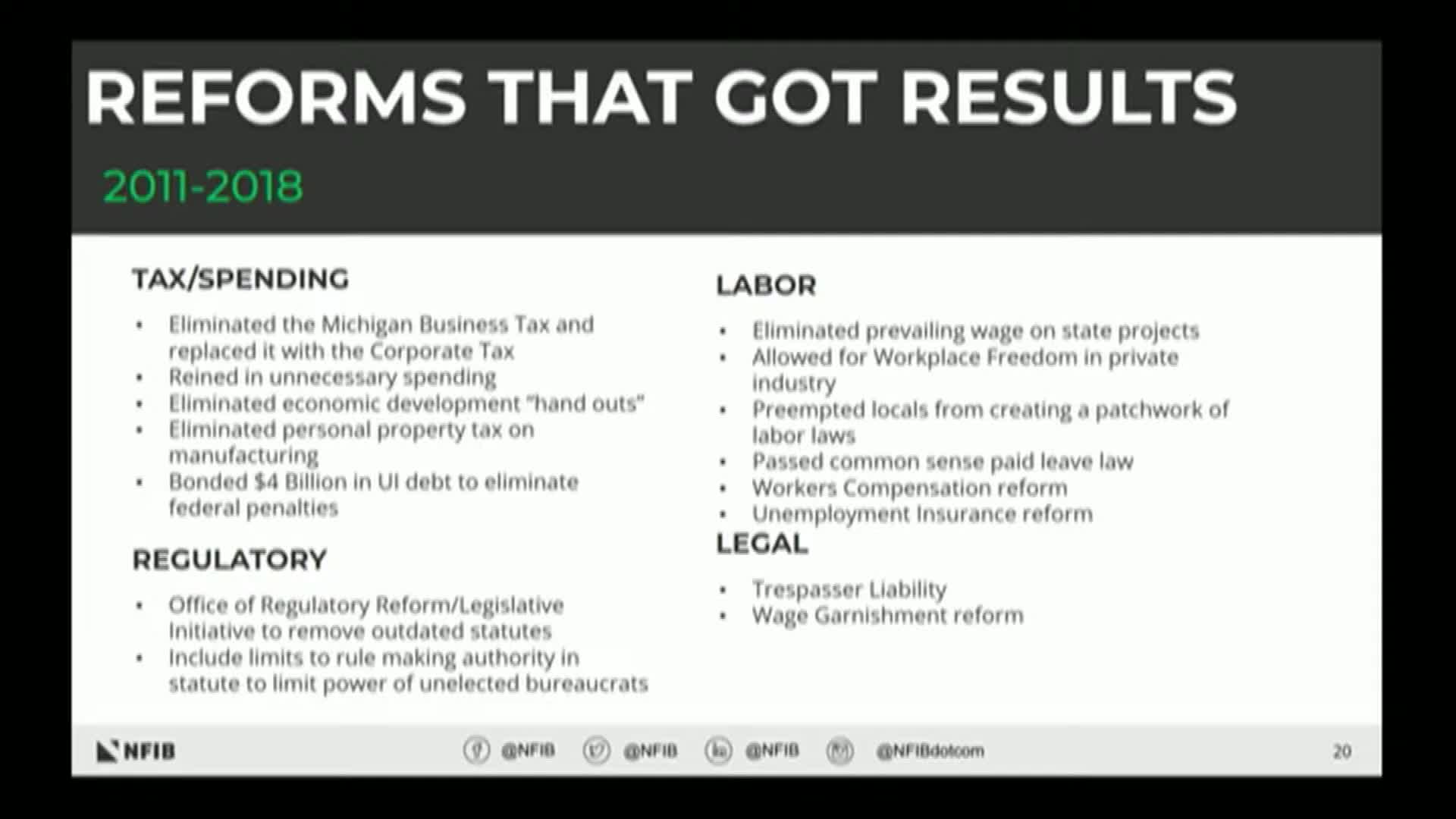

The meeting underscored the importance of these reforms, initiated in 2011, which were designed to simplify the tax structure and eliminate double taxation on small businesses. This shift has been credited with fostering a more level playing field for businesses, allowing them to better predict their tax liabilities without the need for extensive accounting resources.

In addition to tax reforms, the state has made significant progress in managing its budget and reducing unnecessary spending. The elimination of economic development handouts was a notable point of discussion, reflecting a commitment to fiscal responsibility during challenging economic times. Michigan's proactive measures, including paying off a substantial debt in the unemployment insurance trust fund, positioned the state favorably during the COVID-19 pandemic, avoiding reliance on federal loans that burdened other states.

The meeting also touched on regulatory reforms, including the establishment of an office dedicated to regulatory reform, which has worked to streamline regulations and remove outdated laws. This initiative has been crucial in attracting new businesses and retaining existing ones by preventing a confusing patchwork of local labor laws.

Overall, the discussions at the meeting reinforced Michigan's ongoing commitment to enhancing its economic competitiveness through strategic reforms. As the state continues to implement these changes, stakeholders can expect a more robust business environment that supports growth and innovation.

Converted from Economic Competitiveness - 9/4/2025 meeting on September 05, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting