Michigan Small Businesses Represent 47.7% of Employment Says NFIB Presentation

September 05, 2025 | 2025 House Legislature MI, Michigan

Thanks to Scribe from Workplace AI , all articles about Michigan are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

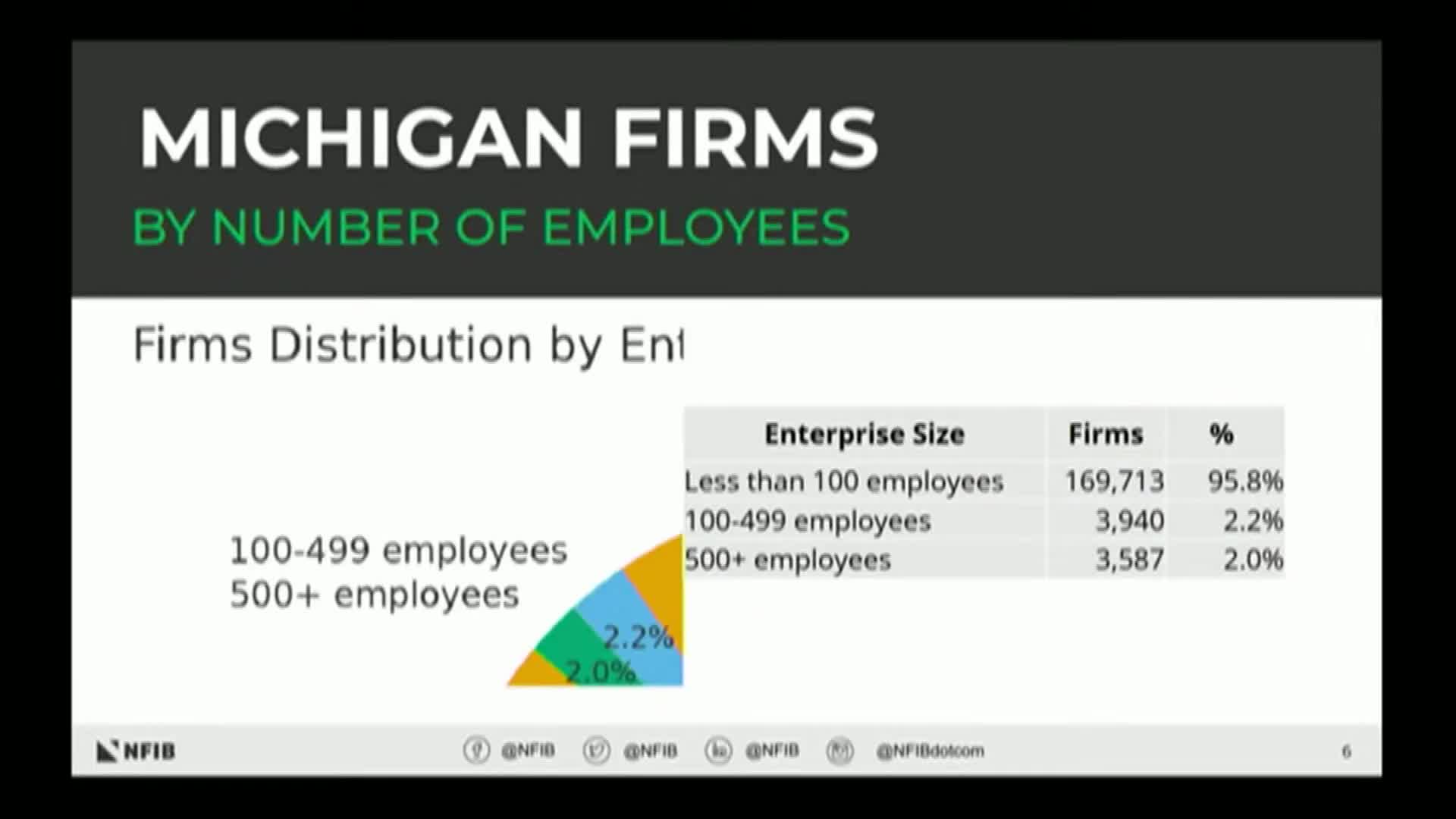

The session began with a presentation that included a pie chart illustrating employment distribution among firms in Michigan. It was noted that 47.7% of employees work for businesses with fewer than 500 employees, emphasizing the significant role of small businesses in the state's labor market. The discussion also covered employment by sector, identifying manufacturing, retail trade, hospitality, professional services, and construction as the leading sectors. However, it was pointed out that for businesses with fewer than 20 employees, the prominence of manufacturing decreases while retail and accommodations gain importance.

A notable point raised during the meeting was the presence of non-employer businesses, which represent independent contractors and entrepreneurs who may also hold full-time jobs. This segment was acknowledged for its potential to grow into larger enterprises over time.

The conversation shifted to taxation, addressing a common misconception that small businesses do not contribute significantly to tax revenues. It was clarified that many small businesses operate as pass-through entities, meaning they pay taxes through individual income tax rather than corporate tax. Historical data from 2016 indicated that small businesses contributed approximately $843 million in taxes, often exceeding the tax contributions of larger corporations when accounting for various tax credits.

The meeting concluded with a reminder of the importance of recognizing the tax contributions of small businesses, particularly as 81% of them are organized as pass-through entities. This insight is crucial for policymakers as they consider tax legislation that impacts small business owners.

Overall, the discussions underscored the vital role of small businesses in Michigan's economy and the need for informed policy decisions that reflect their contributions and challenges.

Converted from Economic Competitiveness - 9/4/2025 meeting on September 05, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting