School District Proposes 0.7252 Tax Rate Amid Homestead Exemption Increase

August 30, 2025 | ALICE ISD, School Districts, Texas

Thanks to Scribe from Workplace AI , all articles about Texas are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

During the workshop, it was reported that the taxable values for the 2025-2026 school year are projected at $1,233,000,000, reflecting a 1.52% decrease from the previous year’s $1,244,000,000. This decline is attributed to an increase in the homestead exemption from $100,000 to $140,000, which will require a vote in November.

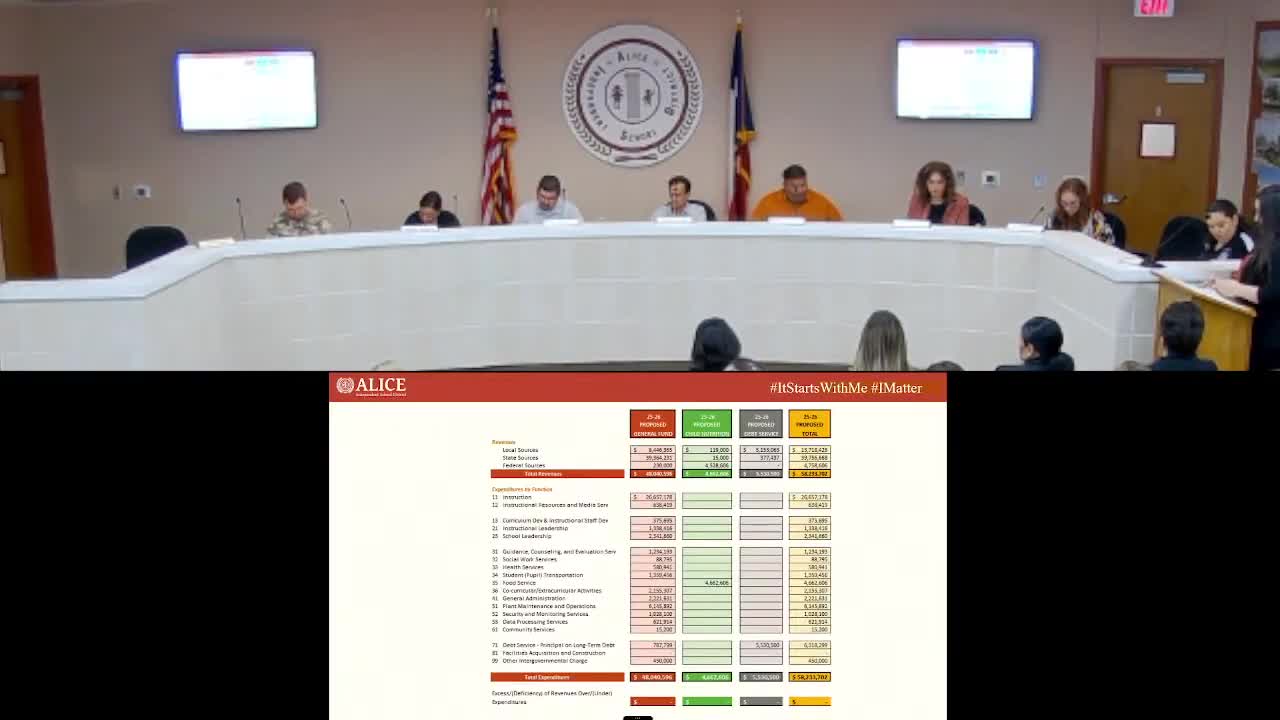

The proposed tax rate for maintenance and operations (M&O) is set at 0.7252, with an interest and sinking (INS) rate of 0.447, totaling 1.1722. This represents a decrease from the previous year’s total rate of 1.1897. The district aims to maintain its financial obligations while ensuring minimal impact on taxpayers. For instance, the average homeowner's tax due is expected to decrease from $91.55 to $0 due to the increased homestead exemption, as the taxable value for homes under the new exemption will be effectively zero.

The discussion emphasized the importance of the M&O rate, which funds daily operations, including staff salaries and student resources, while the INS rate is dedicated to debt repayment. The district highlighted the need for the proposed tax rate to support ongoing capital projects and address rising operational costs, particularly in light of safety mandates and inflation.

The AISD plans to present the proposed tax rate for a vote at the upcoming board meeting, with the intention of ensuring continued investment in educational services while balancing the financial burden on local taxpayers.

Converted from AISD Workshop 8/29/25 meeting on August 30, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting