Parkland Reports 6.7% Increase in Property Values Amid Stable Millage Rate

August 13, 2025 | City of Parkland, Broward County, Florida

Thanks to Republi.us and Family Scribe , all articles about Florida are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

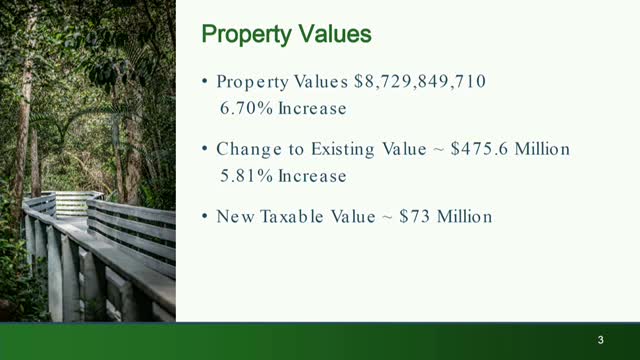

The meeting revealed that Parkland experienced a 6.7% overall increase in property values, totaling approximately $8.7 billion. Notably, the new taxable values rose by $73 million, while existing property values saw a change of $475 million, reflecting a 5.81% increase. This performance places Parkland as the fourth lowest in net increases among Broward County municipalities, where the average net increase was 8.91%. The lower turnover of properties in Parkland, along with the portability of property taxes for new buyers, contributes to this trend of stable property values.

In terms of fiscal management, the city plans to maintain the same millage rate of 4.2979, which has been consistent for the past five years. This decision is expected to generate an additional $2.15 million in revenue. However, city officials acknowledged that expenditures are rising at a faster pace than revenues, raising concerns about the sustainability of this budget strategy in the coming years. Despite these challenges, the city is presenting a balanced budget, reflecting its commitment to responsible financial management while continuing to provide essential services to the community.

As Parkland navigates these financial dynamics, the discussions underscore the importance of strategic planning in maintaining the city's economic health and service levels for its residents.

Converted from Parkland - City Commission Workshop meeting on August 13, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting