Garland City Council reviews 2025 budget and sets flat property tax rates

August 16, 2025 | Garland, Dallas County, Texas

Thanks to Scribe from Workplace AI , all articles about Texas are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

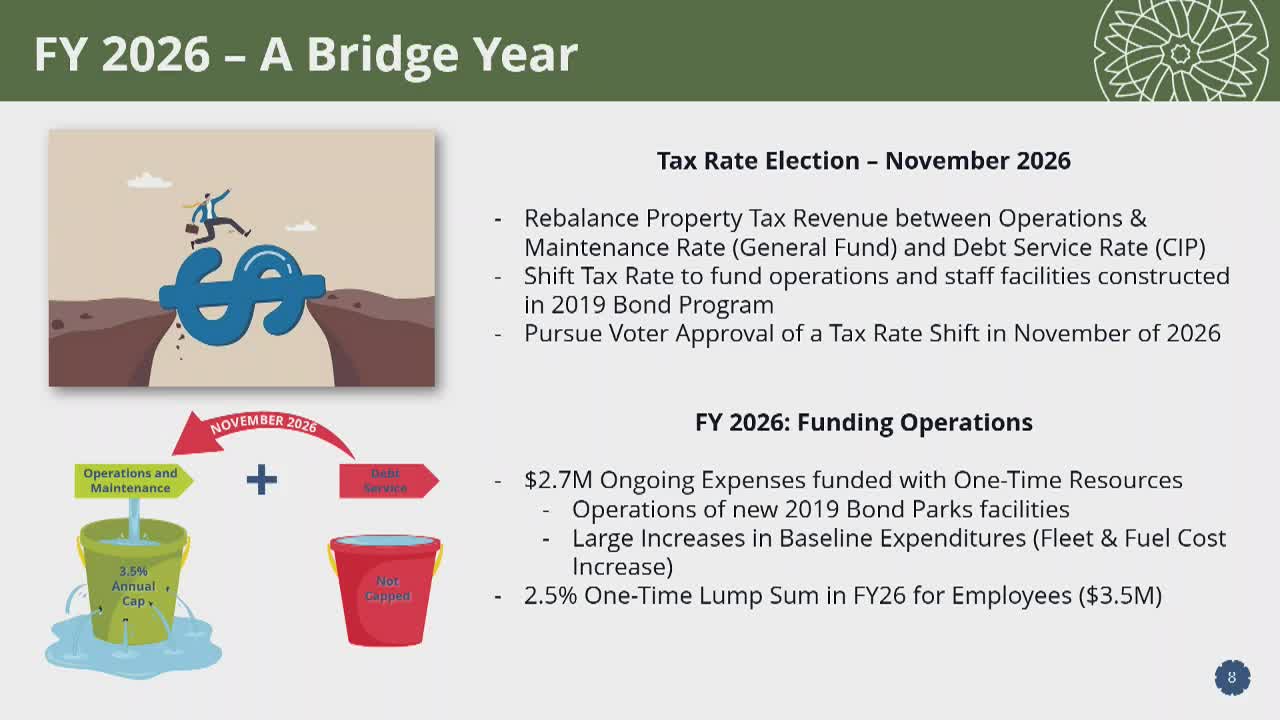

A significant aspect of the proposed budget includes utilizing one-time resources to cover ongoing expenses in the general fund. This approach will help manage costs related to parks maintenance and fleet operations, while also providing a 2.5% one-time lump sum payment for city employees, totaling approximately $3.5 million.

The council reported a certified property tax base of $28.3 billion, reflecting a 5.6% increase from the previous year. This growth is attributed largely to a record level of new construction, which amounted to $552 million, with commercial properties contributing significantly to the general fund. Despite this growth, the council plans to maintain the property tax rate at its current level, adhering to state regulations that limit revenue increases.

Changes to homestead and senior exemptions were also discussed, with the council approving a 1% increase in the homestead exemption and a $4,000 increase for seniors. This adjustment means that Garland now offers an 11% homestead exemption and a $60,000 senior exemption, aimed at easing the tax burden on residents.

For homeowners, the average market value of a single-family residence in Garland increased by only 1.1%, resulting in an average annual city tax of $1,838—a 5.5% increase from 2024. This contrasts with the broader Dallas County average market value increase of 4.76%, raising concerns about Garland's property tax base growth compared to neighboring cities.

As the city prepares for the upcoming tax rate election and continues to navigate budgetary challenges, officials remain focused on balancing fiscal responsibility with the needs of the community. The discussions from this workshop will play a crucial role in shaping Garland's financial landscape in the coming years.

Converted from Garland - Budget Workshop meeting on August 16, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting