Investment Committee Proposes Changes to International Equity Management Strategy

August 13, 2025 | Lexington City, Fayette County, Kentucky

Thanks to Scribe from Workplace AI , all articles about Kentucky are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

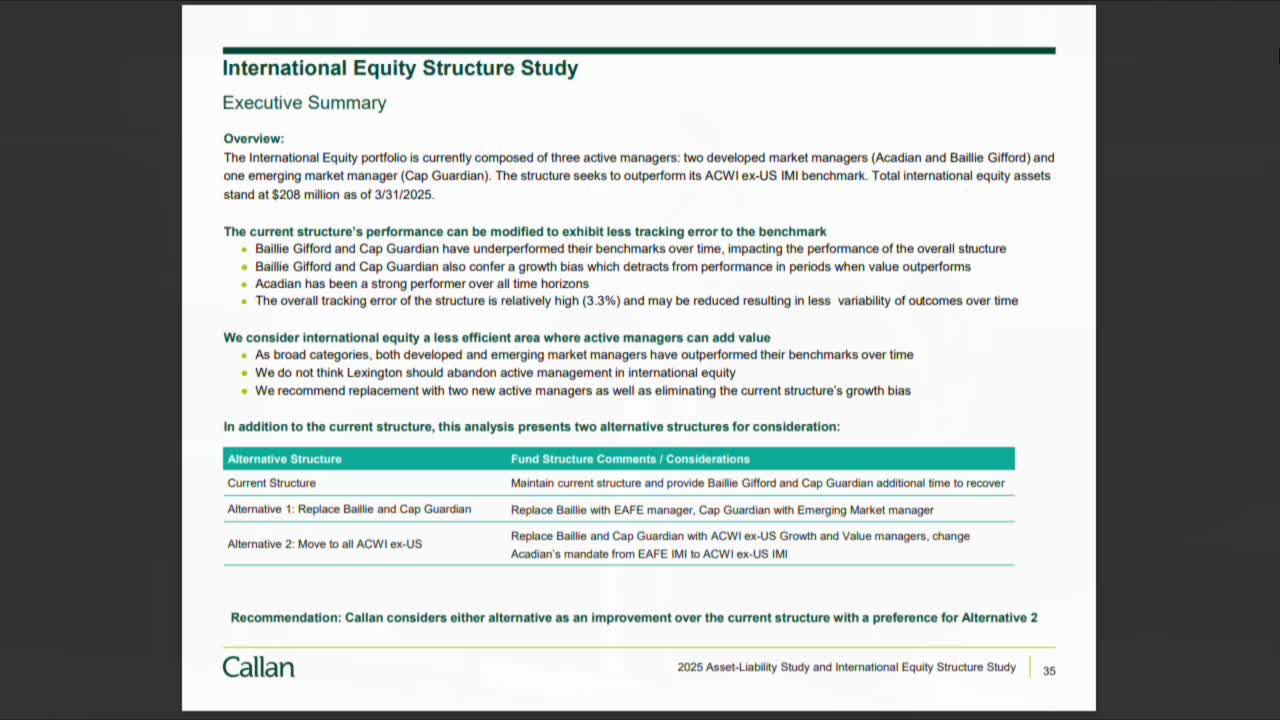

The board is exploring two alternative strategies to address these issues. The first option involves replacing both Bailey Gifford and Capital Group with managers that have a more balanced approach, focusing less on growth. The second option suggests maintaining Acadian as the core manager while complementing it with both a value manager and a growth manager to create a more diversified portfolio.

Key discussions highlighted the importance of active management in non-U.S. equity markets, where less efficient markets can benefit from strategic investment decisions. The board emphasized the need to streamline the portfolio and potentially broaden the discretion of international equity managers to better allocate resources between developed and emerging markets.

The proposed changes aim to reduce the current growth bias and improve overall tracking error, which currently stands at 3.3%. By adjusting the investment strategy, the board hopes to outperform benchmarks and achieve a more stable long-term path for the pension fund. The outcome of these discussions could significantly impact the financial health of the pension fund, ensuring better returns for its members in the future.

Converted from Lexington - Police & Fire Pension Board Meeting meeting on August 13, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting