NASDAQ explores AI's role in enhancing market quality and operational efficiency

July 30, 2025 | Banking, Housing, and Urban Affairs: Senate Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

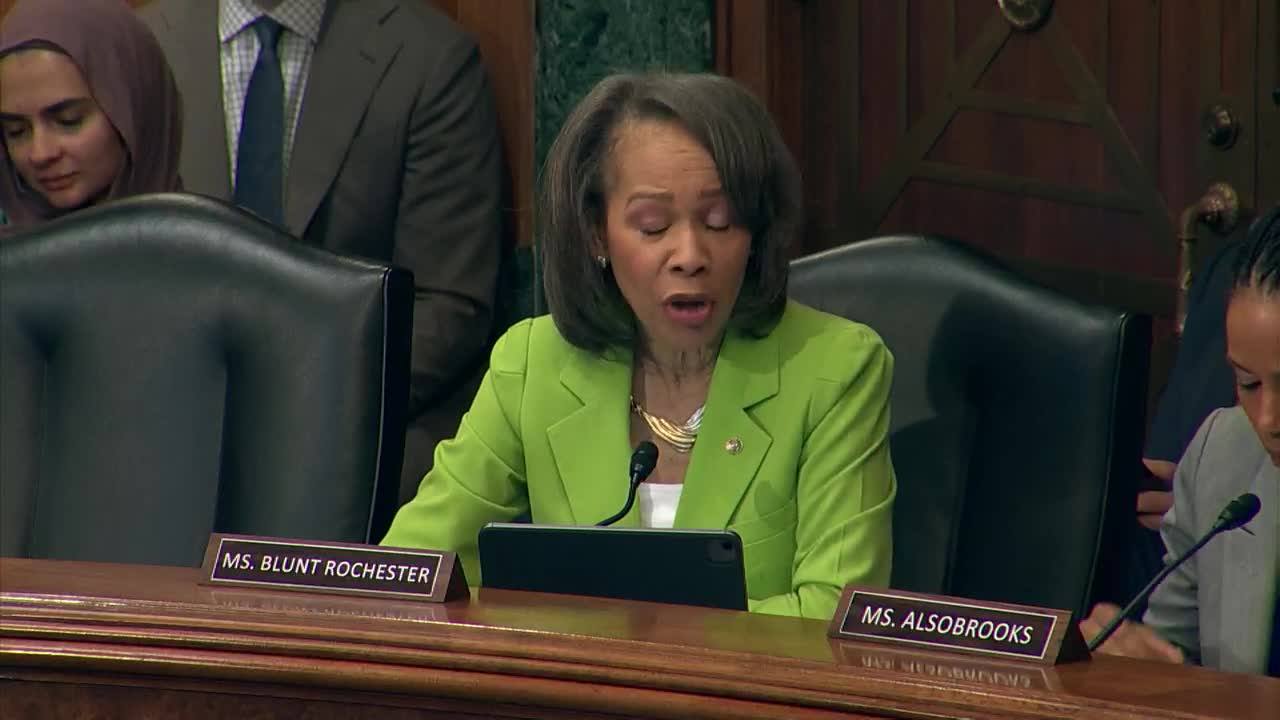

The U.S. Senate Committee on Banking, Housing, and Urban Affairs held a subcommittee hearing on July 30, 2025, focusing on the role of artificial intelligence (AI) in capital and insurance markets. The session aimed to explore how AI can enhance market oversight and stability while addressing potential risks associated with its implementation.

Key discussions centered on the need for concrete metrics to evaluate AI's effectiveness in improving market operations. Panelists emphasized the importance of measuring both the inputs and outputs of AI models. They highlighted that understanding the data used to train these models is crucial for assessing their performance. This approach aims to ensure that AI contributes positively to operational efficiency and effectiveness, particularly in detecting fraud and market manipulation.

The conversation also touched on the significance of public-private partnerships in gathering sufficient data to monitor AI's impact across the financial system. Concerns were raised about smaller companies and first-time investors potentially facing disadvantages in an AI-driven market. The panelists agreed that AI should not exacerbate existing inequalities but rather serve as a tool for democratizing access to market opportunities.

One of the witnesses, representing NASDAQ, discussed the company's commitment to enhancing market quality through AI. They outlined two primary metrics for evaluating market performance: the bid-ask spread of listed companies and the overall liquidity across the market. The goal is to ensure that all companies, regardless of size, benefit from a fair and accessible trading environment.

Senators expressed the need for a balanced approach to AI integration, recognizing its potential for innovation while remaining vigilant about the associated risks. The hearing underscored the responsibility of lawmakers to ensure that AI technologies are used transparently and equitably, preventing new forms of exclusion in financial markets.

As the meeting concluded, the committee acknowledged the ongoing discussions necessary to shape policies that will govern AI's role in the financial sector, emphasizing the importance of accountability and data governance in this evolving landscape.

Key discussions centered on the need for concrete metrics to evaluate AI's effectiveness in improving market operations. Panelists emphasized the importance of measuring both the inputs and outputs of AI models. They highlighted that understanding the data used to train these models is crucial for assessing their performance. This approach aims to ensure that AI contributes positively to operational efficiency and effectiveness, particularly in detecting fraud and market manipulation.

The conversation also touched on the significance of public-private partnerships in gathering sufficient data to monitor AI's impact across the financial system. Concerns were raised about smaller companies and first-time investors potentially facing disadvantages in an AI-driven market. The panelists agreed that AI should not exacerbate existing inequalities but rather serve as a tool for democratizing access to market opportunities.

One of the witnesses, representing NASDAQ, discussed the company's commitment to enhancing market quality through AI. They outlined two primary metrics for evaluating market performance: the bid-ask spread of listed companies and the overall liquidity across the market. The goal is to ensure that all companies, regardless of size, benefit from a fair and accessible trading environment.

Senators expressed the need for a balanced approach to AI integration, recognizing its potential for innovation while remaining vigilant about the associated risks. The hearing underscored the responsibility of lawmakers to ensure that AI technologies are used transparently and equitably, preventing new forms of exclusion in financial markets.

As the meeting concluded, the committee acknowledged the ongoing discussions necessary to shape policies that will govern AI's role in the financial sector, emphasizing the importance of accountability and data governance in this evolving landscape.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting