City Council Reviews Tax Impact on Residential and Commercial Property Owners

August 11, 2025 | Idaho Falls, Bonneville County, Idaho

Powered by Soar

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

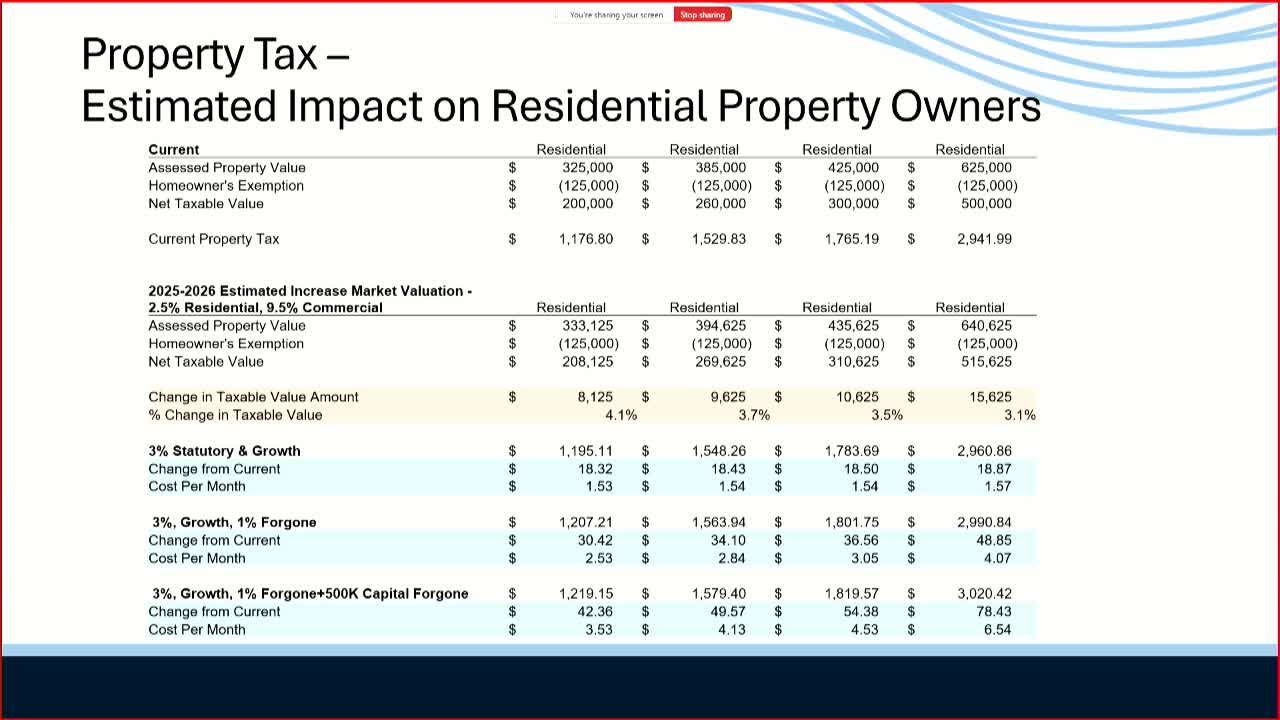

For residential property owners, the anticipated tax increase ranges from $42 to $78 annually, depending on home values between $325,000 and $625,000. This translates to a monthly cost increase of approximately $3.50 to $6.50. Council members emphasized the importance of clear communication regarding these changes, as they prepare to address inquiries from residents.

The discussion also covered the impact on commercial property owners, where the tax increase varies significantly based on property value. For businesses valued between $500,000 and $10 million, the projected annual increase could range from $265 to over $5,000, equating to monthly increases of $22 to $442. The council noted that larger businesses, such as hospitals, have different assessment methods based on revenue rather than property value, which complicates the tax implications.

While the council awaits a detailed breakdown from the county, expected in November, they are proactively preparing to explain the budget changes to the community. This session highlighted the city's commitment to transparency and responsiveness in addressing the financial impacts on its residents and businesses. As the budget process unfolds, the council aims to ensure that the community remains informed and engaged.

Converted from Idaho Falls City - City Council Work Session meeting on August 11, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting