Collin County Tax Assessor Scott Grigg discusses budgeting challenges and goals

August 05, 2025 | Collin County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

On August 5, 2025, Collin County officials convened for a budget workshop aimed at discussing the fiscal strategies for the upcoming 2026 budget. The meeting highlighted key operational needs within the county's law enforcement and tax assessment departments, reflecting ongoing efforts to enhance public safety and service efficiency.

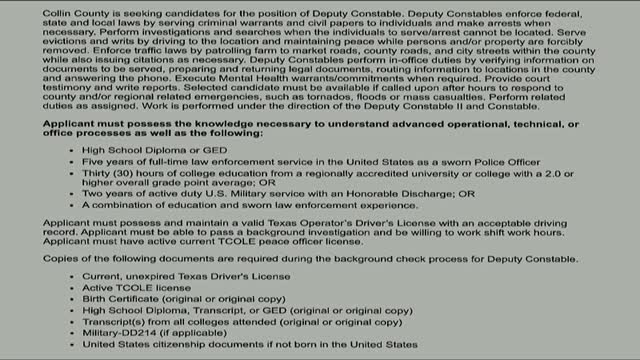

A significant portion of the discussion centered around the responsibilities of the sheriff's office. Officials explored the impact of additional duties, such as responding to emergencies and assisting with arrests, on the department's staffing needs. One commissioner inquired whether addressing these operational challenges could alleviate some of the demands on the sheriff's office, potentially reducing the need for additional deputies. The sheriff acknowledged the importance of collaboration with probation departments, emphasizing that a strong working relationship exists, which could help streamline operations and improve efficiency.

Following the sheriff's remarks, Scott Grigg, the county's new tax assessor-collector, presented his insights on the budgeting process. Grigg expressed gratitude for the support he received from the budgeting department as he navigated his first budget cycle. He assured the commissioners that his requests for resources were carefully considered and aimed at establishing Collin County's tax office as a leading entity in Texas.

The discussions during the workshop underscored the county's commitment to addressing operational challenges while ensuring that essential services are adequately funded. As the budget process continues, officials will need to weigh the needs of law enforcement against the resources available, ensuring that public safety and efficient tax collection remain priorities for the community. The next steps will involve further deliberations on the proposed budget and potential adjustments based on feedback from the workshop.

A significant portion of the discussion centered around the responsibilities of the sheriff's office. Officials explored the impact of additional duties, such as responding to emergencies and assisting with arrests, on the department's staffing needs. One commissioner inquired whether addressing these operational challenges could alleviate some of the demands on the sheriff's office, potentially reducing the need for additional deputies. The sheriff acknowledged the importance of collaboration with probation departments, emphasizing that a strong working relationship exists, which could help streamline operations and improve efficiency.

Following the sheriff's remarks, Scott Grigg, the county's new tax assessor-collector, presented his insights on the budgeting process. Grigg expressed gratitude for the support he received from the budgeting department as he navigated his first budget cycle. He assured the commissioners that his requests for resources were carefully considered and aimed at establishing Collin County's tax office as a leading entity in Texas.

The discussions during the workshop underscored the county's commitment to addressing operational challenges while ensuring that essential services are adequately funded. As the budget process continues, officials will need to weigh the needs of law enforcement against the resources available, ensuring that public safety and efficient tax collection remain priorities for the community. The next steps will involve further deliberations on the proposed budget and potential adjustments based on feedback from the workshop.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting