City Council Approves $5.4M for Fire Apparatus and Infrastructure Debt Issuances

August 05, 2025 | Amarillo, Potter County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

In the heart of Amarillo's city hall, council members gathered to discuss the financial landscape of the city, focusing on the implications of recent debt issuances and tax rates. The meeting, held on August 5, 2025, revealed a significant shift in the allocation of the city’s tax revenue, with a growing portion now directed towards debt service.

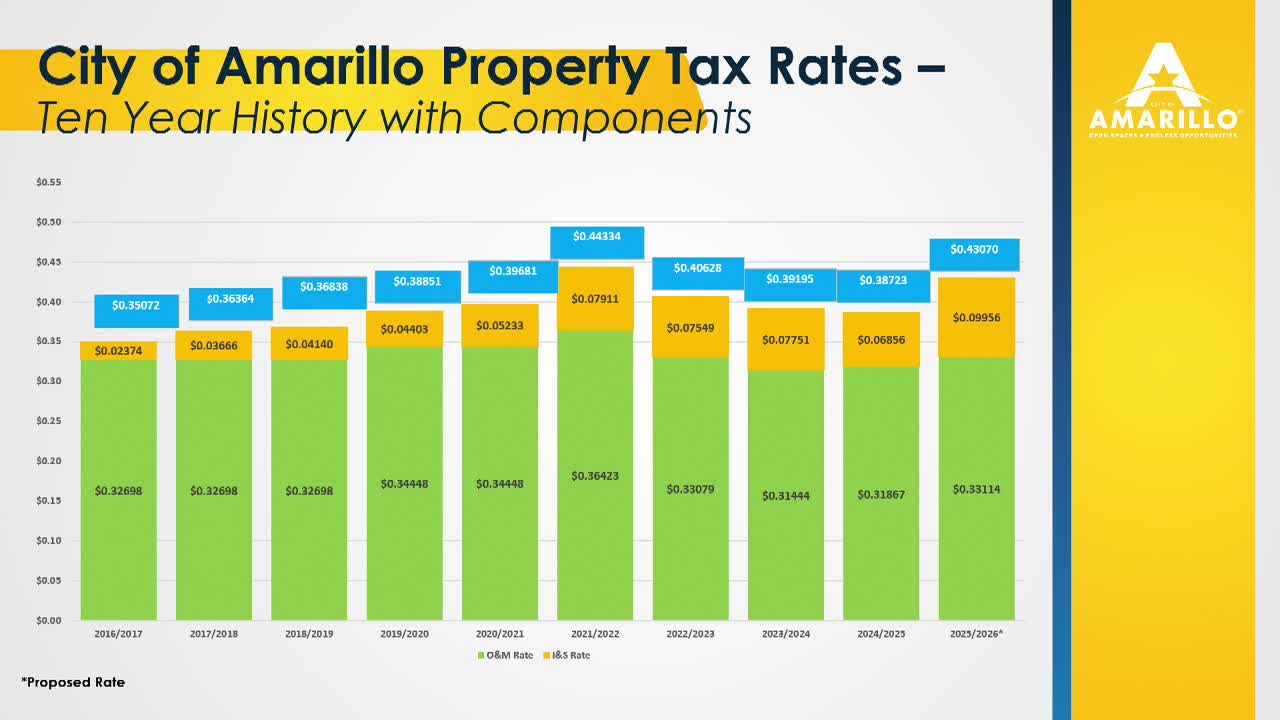

As the discussion unfolded, it became clear that the city is navigating a complex financial environment. The council highlighted that approximately 77% of the tax rate is now allocated for operations and maintenance, while 23% is earmarked for debt service. This marks a notable change from previous years, where a larger share of tax revenue was devoted to operational needs.

The council reviewed the proposed tax rate for the upcoming fiscal year, which includes a breakdown of funding for essential services and projects. Last year, the operating and maintenance rate was just under 33 cents, which has now shifted to accommodate a new debt issuance of $5.4 million. This funding is crucial for various projects, including fire apparatus, street improvements, and park enhancements.

A key point of discussion was the total property tax-supported debt service, which now stands at $18.3 million. This figure reflects an increase of $5.4 million compared to the previous year, raising questions about the city’s long-term financial strategy. Council members expressed concerns about the sustainability of this debt, particularly as they consider the implications for future budgets.

The council also examined the structure of the new debt, which includes shorter repayment terms to align with the lifespan of the assets being financed. For instance, the fire apparatus will be financed over a 13-year period, while street projects will have a 10-year repayment plan. This approach aims to ensure that the city can manage its debt effectively while still investing in critical infrastructure.

As the meeting concluded, the council members acknowledged the challenges ahead. Balancing operational needs with debt obligations will require careful planning and strategic decision-making. The discussions underscored the importance of transparency and community engagement as Amarillo navigates its financial future, ensuring that residents remain informed about how their tax dollars are being utilized. The decisions made in these meetings will shape the city’s landscape for years to come, highlighting the delicate balance between growth and fiscal responsibility.

As the discussion unfolded, it became clear that the city is navigating a complex financial environment. The council highlighted that approximately 77% of the tax rate is now allocated for operations and maintenance, while 23% is earmarked for debt service. This marks a notable change from previous years, where a larger share of tax revenue was devoted to operational needs.

The council reviewed the proposed tax rate for the upcoming fiscal year, which includes a breakdown of funding for essential services and projects. Last year, the operating and maintenance rate was just under 33 cents, which has now shifted to accommodate a new debt issuance of $5.4 million. This funding is crucial for various projects, including fire apparatus, street improvements, and park enhancements.

A key point of discussion was the total property tax-supported debt service, which now stands at $18.3 million. This figure reflects an increase of $5.4 million compared to the previous year, raising questions about the city’s long-term financial strategy. Council members expressed concerns about the sustainability of this debt, particularly as they consider the implications for future budgets.

The council also examined the structure of the new debt, which includes shorter repayment terms to align with the lifespan of the assets being financed. For instance, the fire apparatus will be financed over a 13-year period, while street projects will have a 10-year repayment plan. This approach aims to ensure that the city can manage its debt effectively while still investing in critical infrastructure.

As the meeting concluded, the council members acknowledged the challenges ahead. Balancing operational needs with debt obligations will require careful planning and strategic decision-making. The discussions underscored the importance of transparency and community engagement as Amarillo navigates its financial future, ensuring that residents remain informed about how their tax dollars are being utilized. The decisions made in these meetings will shape the city’s landscape for years to come, highlighting the delicate balance between growth and fiscal responsibility.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting