Amarillo City Council Discusses $9M Revenue Increase and Debt Management Strategies

August 05, 2025 | Amarillo, Potter County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

The Amarillo City Council Workshop held on August 5, 2025, focused on the city’s financial outlook, including budget adjustments and debt management strategies. Key discussions revolved around the general fund revenue, anticipated increases in property and sales taxes, and the implications of new legislation affecting franchise fees.

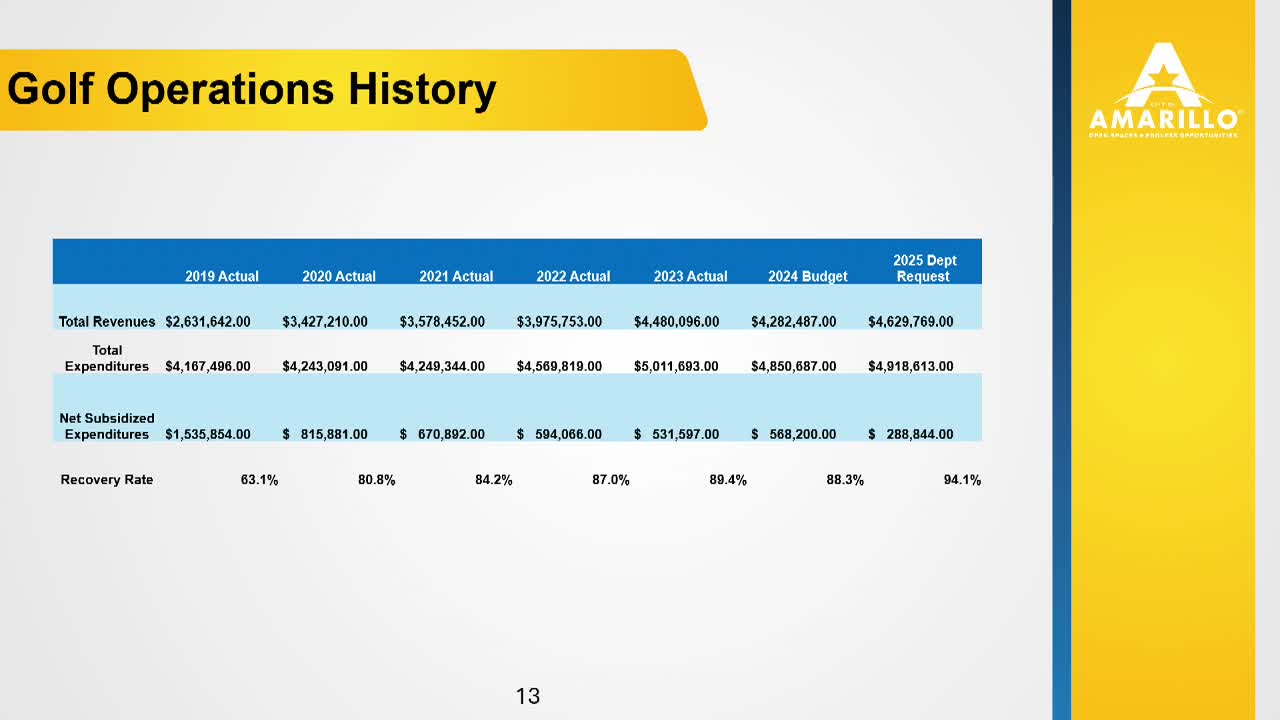

City officials reported that the general fund revenue is projected to rise to approximately $269.9 million, an increase of $9 million from the previous budget. This growth is attributed to a $3.8 million increase in property taxes and a $2.7 million rise in sales tax revenue, which remains the largest source of funding for the city at over 30%. The council emphasized the importance of maintaining efficient operations to minimize the impact on the general fund, with a projected subsidy of $289,000 for the upcoming year.

A significant concern raised during the meeting was the anticipated decrease in Federal Transit Administration (FTA) grant funding, expected to drop by $1.4 million due to Amarillo's classification as a larger community. This change will affect the city’s transit operations and overall budget.

The council also reviewed the city’s outstanding debt, which totals approximately $554.6 million. Discussions included proposed debt issuances for various projects, including fire apparatus and water infrastructure, which could increase the total debt to around $602.9 million if approved. The council is considering strategies for managing this debt, including refinancing options to take advantage of favorable interest rates.

Additionally, the council addressed the implications of Senate Bill 9, which will exclude streaming services from the definition of video programming under Texas law, thereby eliminating the ability to collect franchise fees from these services starting September 1, 2025. This legislative change is expected to negatively impact the city’s revenue from franchise fees.

The meeting concluded with a commitment to continue monitoring the city’s financial health and exploring opportunities for revenue enhancement while managing debt responsibly. The council plans to revisit these topics in future sessions as they finalize the budget and address the challenges posed by changing economic conditions and legislative impacts.

City officials reported that the general fund revenue is projected to rise to approximately $269.9 million, an increase of $9 million from the previous budget. This growth is attributed to a $3.8 million increase in property taxes and a $2.7 million rise in sales tax revenue, which remains the largest source of funding for the city at over 30%. The council emphasized the importance of maintaining efficient operations to minimize the impact on the general fund, with a projected subsidy of $289,000 for the upcoming year.

A significant concern raised during the meeting was the anticipated decrease in Federal Transit Administration (FTA) grant funding, expected to drop by $1.4 million due to Amarillo's classification as a larger community. This change will affect the city’s transit operations and overall budget.

The council also reviewed the city’s outstanding debt, which totals approximately $554.6 million. Discussions included proposed debt issuances for various projects, including fire apparatus and water infrastructure, which could increase the total debt to around $602.9 million if approved. The council is considering strategies for managing this debt, including refinancing options to take advantage of favorable interest rates.

Additionally, the council addressed the implications of Senate Bill 9, which will exclude streaming services from the definition of video programming under Texas law, thereby eliminating the ability to collect franchise fees from these services starting September 1, 2025. This legislative change is expected to negatively impact the city’s revenue from franchise fees.

The meeting concluded with a commitment to continue monitoring the city’s financial health and exploring opportunities for revenue enhancement while managing debt responsibly. The council plans to revisit these topics in future sessions as they finalize the budget and address the challenges posed by changing economic conditions and legislative impacts.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting