City Budget Projects $81M Sales Tax Revenue Amid Steady Growth Trends

August 05, 2025 | Amarillo, Potter County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

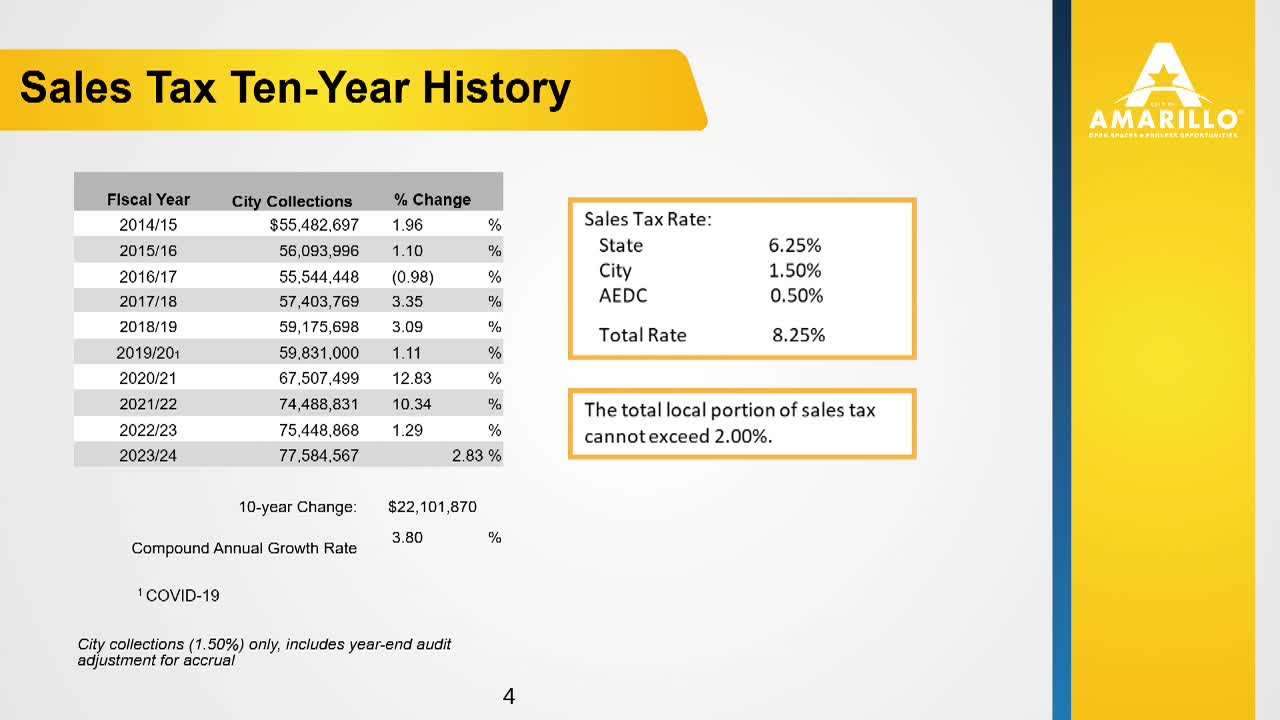

In the heart of Amarillo's city hall, council members gathered to discuss the financial landscape of the city, revealing a promising yet cautious outlook for the coming years. The meeting highlighted a decade-long trend of growth in sales tax revenue, particularly as the city emerged from the challenges posed by the COVID-19 pandemic. However, recent years have shown a stabilization in these figures, with current collections trending slightly above budget by approximately 2.4%. The city anticipates finishing the year with revenues nearing $80 million, leading to a proposed sales tax budget of $81.17 million for the next fiscal year.

The discussions also delved into the complexities of the city's gross receipts business tax, commonly referred to as franchise fees. These fees are charged to utilities for their use of city rights-of-way, with rates set at the maximum allowed by state law. Council members expressed concerns about the declining revenue from telephone and cable utilities, a trend attributed to changes in state legislation that now allows these services to pay the lesser of two rates.

As the conversation unfolded, the impact of shifting consumer habits towards streaming services was a focal point. Council members questioned whether there could be adjustments to the city's revenue model to account for this shift, as traditional cable and telephone services continue to decline. While the city is currently at the maximum allowable rates, there is a commitment to explore potential avenues for relief and adaptation in response to these evolving market conditions.

The meeting underscored the city's proactive approach to managing its finances amid changing economic landscapes, balancing optimism with a strategic outlook on future revenue sources. As Amarillo prepares for the next fiscal year, the council's discussions reflect a broader awareness of the challenges and opportunities that lie ahead in maintaining the city's financial health.

The discussions also delved into the complexities of the city's gross receipts business tax, commonly referred to as franchise fees. These fees are charged to utilities for their use of city rights-of-way, with rates set at the maximum allowed by state law. Council members expressed concerns about the declining revenue from telephone and cable utilities, a trend attributed to changes in state legislation that now allows these services to pay the lesser of two rates.

As the conversation unfolded, the impact of shifting consumer habits towards streaming services was a focal point. Council members questioned whether there could be adjustments to the city's revenue model to account for this shift, as traditional cable and telephone services continue to decline. While the city is currently at the maximum allowable rates, there is a commitment to explore potential avenues for relief and adaptation in response to these evolving market conditions.

The meeting underscored the city's proactive approach to managing its finances amid changing economic landscapes, balancing optimism with a strategic outlook on future revenue sources. As Amarillo prepares for the next fiscal year, the council's discussions reflect a broader awareness of the challenges and opportunities that lie ahead in maintaining the city's financial health.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting