Texas Hospital District Proposes Budget Amid Federal Funding Uncertainty

August 05, 2025 | Bexar County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

In the heart of Bexar County, a pivotal meeting unfolded as officials gathered to discuss the future of healthcare funding and tax rates. Under the bright lights of the Commissioners Court, the conversation centered on the financial landscape of the county's clinical services division, revealing both challenges and opportunities ahead.

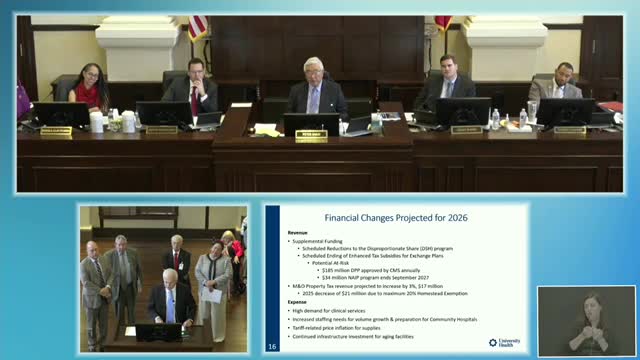

The meeting highlighted significant changes at both state and federal levels that could impact healthcare funding. A looming reduction in Disproportionate Share Hospital (DSH) funding, coupled with the scheduled end of enhanced tax subsidies for exchange plans in January 2026, raised concerns. Officials warned that if these subsidies disappear, nearly half of the individuals currently benefiting from them might drop their coverage, potentially leading to an increase in uninsured patients and a decrease in revenue from payers.

Despite these uncertainties, the county anticipates maintaining a robust budget. With a proposed tax rate that would add $17 million to the Maintenance and Operations (M&O) revenue, officials expressed cautious optimism. Last year, a significant increase in the homestead exemption had resulted in a $21 million drop in M&O revenue, prompting a more conservative approach this year.

The financial outlook for the clinical services division is projected at nearly $2.8 billion in total revenues, with an expected operational gain of $150 million. However, the potential loss of $34 million from the Network Access Improvement Program by 2027 looms large, emphasizing the need for strategic planning.

As the discussion progressed, the county's property values were also a focal point. Assessed values for the hospital district rose by 3.4%, reflecting a growing community. The average tax burden for homestead taxpayers stands at $746, with significant savings attributed to the existing exemptions. The 20% homestead exemption alone is projected to save taxpayers around $74 million annually.

In a landscape where healthcare funding is increasingly complex, Bexar County officials remain committed to navigating these challenges. As they prepare for the upcoming budget adoption later this year, the emphasis on maintaining essential services while ensuring fiscal responsibility will be crucial. The meeting concluded with a sense of determination, as officials recognized the importance of their decisions for the health and well-being of the community they serve.

The meeting highlighted significant changes at both state and federal levels that could impact healthcare funding. A looming reduction in Disproportionate Share Hospital (DSH) funding, coupled with the scheduled end of enhanced tax subsidies for exchange plans in January 2026, raised concerns. Officials warned that if these subsidies disappear, nearly half of the individuals currently benefiting from them might drop their coverage, potentially leading to an increase in uninsured patients and a decrease in revenue from payers.

Despite these uncertainties, the county anticipates maintaining a robust budget. With a proposed tax rate that would add $17 million to the Maintenance and Operations (M&O) revenue, officials expressed cautious optimism. Last year, a significant increase in the homestead exemption had resulted in a $21 million drop in M&O revenue, prompting a more conservative approach this year.

The financial outlook for the clinical services division is projected at nearly $2.8 billion in total revenues, with an expected operational gain of $150 million. However, the potential loss of $34 million from the Network Access Improvement Program by 2027 looms large, emphasizing the need for strategic planning.

As the discussion progressed, the county's property values were also a focal point. Assessed values for the hospital district rose by 3.4%, reflecting a growing community. The average tax burden for homestead taxpayers stands at $746, with significant savings attributed to the existing exemptions. The 20% homestead exemption alone is projected to save taxpayers around $74 million annually.

In a landscape where healthcare funding is increasingly complex, Bexar County officials remain committed to navigating these challenges. As they prepare for the upcoming budget adoption later this year, the emphasis on maintaining essential services while ensuring fiscal responsibility will be crucial. The meeting concluded with a sense of determination, as officials recognized the importance of their decisions for the health and well-being of the community they serve.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting