Newcastle County Residents Speak Out Against Tyler Technologies Tax Assessment Controversy

August 05, 2025 | New Castle County, Delaware

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

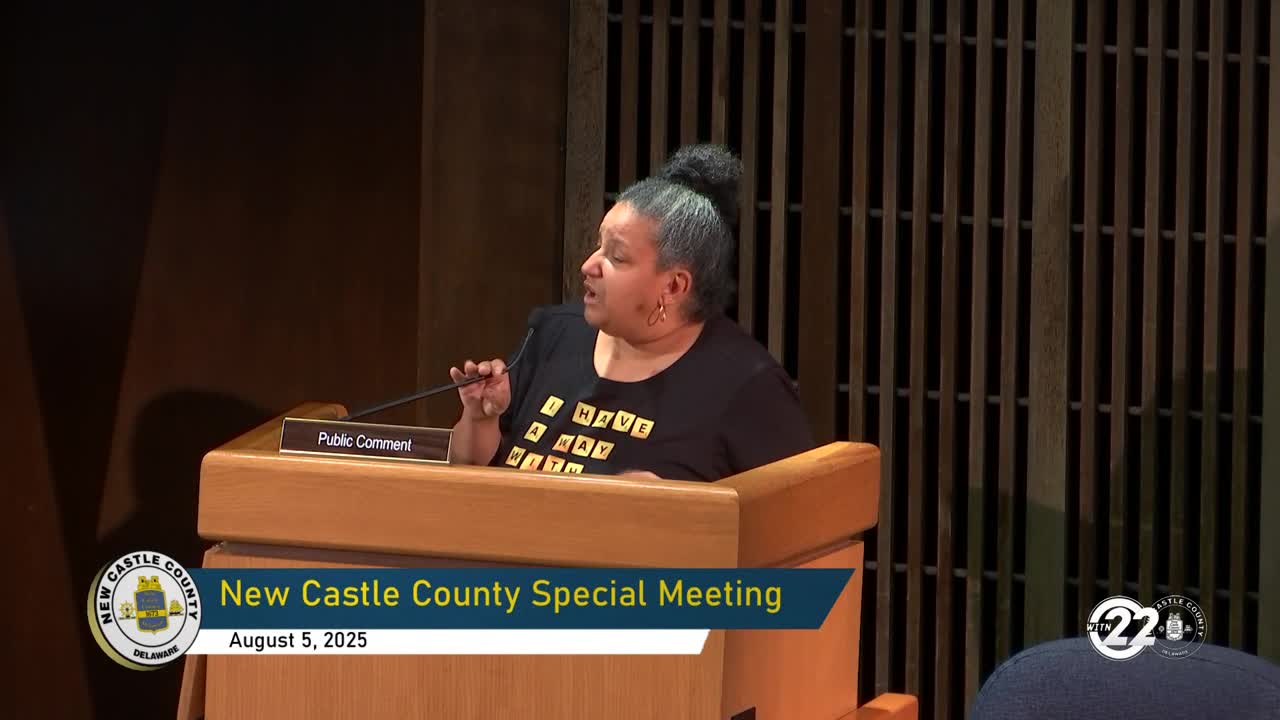

The New Castle County Council meeting on August 5, 2025, focused heavily on the recent property tax increases that have sparked significant concern among residents. Several constituents voiced their frustrations regarding the steep hikes in property taxes, which some claimed have nearly doubled within a year.

One resident expressed confusion over the factors that led to such drastic tax increases, particularly highlighting the lack of individual property assessments. They raised concerns about the impact on low-income homeowners, stating that the new tax rates are not feasible for many families struggling to make ends meet.

Another speaker, Rochelle Wilson, described the tax assessments as "immoral" and "unconstitutional." She criticized the process, claiming that there were no fair warnings or appeal hearings provided to residents. Wilson argued that the demands for payment, sometimes exceeding $2,000, were unreasonable and likened the situation to extortion. She called for a full reassessment by a reputable company and urged the council to freeze or roll back the tax increases until a fair process is established.

Joe Walls, a veteran advocate, also shared his concerns, emphasizing the struggles faced by disabled veterans and low-income individuals. He argued that taxes should be means-tested, suggesting that those who cannot afford to pay should not be taxed. Walls highlighted the need for wealthier residents to contribute their fair share to support the community.

The meeting underscored a growing discontent among residents regarding the property tax reassessment process, with many calling for transparency and accountability from local government officials. As the council continues to address these issues, the voices of concerned constituents reflect a pressing need for a more equitable taxation system in New Castle County.

One resident expressed confusion over the factors that led to such drastic tax increases, particularly highlighting the lack of individual property assessments. They raised concerns about the impact on low-income homeowners, stating that the new tax rates are not feasible for many families struggling to make ends meet.

Another speaker, Rochelle Wilson, described the tax assessments as "immoral" and "unconstitutional." She criticized the process, claiming that there were no fair warnings or appeal hearings provided to residents. Wilson argued that the demands for payment, sometimes exceeding $2,000, were unreasonable and likened the situation to extortion. She called for a full reassessment by a reputable company and urged the council to freeze or roll back the tax increases until a fair process is established.

Joe Walls, a veteran advocate, also shared his concerns, emphasizing the struggles faced by disabled veterans and low-income individuals. He argued that taxes should be means-tested, suggesting that those who cannot afford to pay should not be taxed. Walls highlighted the need for wealthier residents to contribute their fair share to support the community.

The meeting underscored a growing discontent among residents regarding the property tax reassessment process, with many calling for transparency and accountability from local government officials. As the council continues to address these issues, the voices of concerned constituents reflect a pressing need for a more equitable taxation system in New Castle County.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting