City Council Approves Fiscal Year 2025 Budget and Adjusts Tax Rates

August 04, 2025 | City of Lake Jackson, Brazoria County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

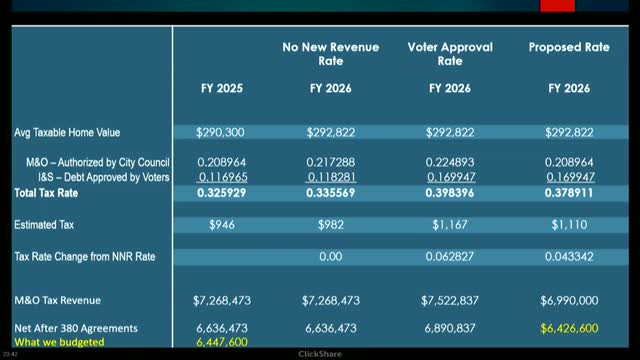

Lake Jackson City Council has taken significant steps to manage its budget and tax rates during the meeting held on August 4, 2025. A key decision was made to utilize $131,000 from the fund balance to mitigate the impact of rising interest rates on debt payments. This proactive measure aims to soften the financial burden on residents by slightly adjusting the tax rates.

The council discussed maintaining the Maintenance and Operations (M&O) tax rate at 0.02, which will result in a decrease in tax revenue for the upcoming year. Additionally, a modest increase in the proposed sales tax was approved, alongside a reduction of $50,000 in the 380 agreement. The recommended debt service tax rate is set at 0.378911, which remains lower than neighboring cities in Brazoria County, countering misconceptions about high local taxes.

The council also called for a public hearing to discuss the proposed budget and tax rate of 0.39484 per $100, scheduled for August 18, 2025. This meeting will provide an opportunity for residents to engage with council members about the fiscal plans for the upcoming year.

In other discussions, updates on emergency preparedness were highlighted, showcasing improvements to the city's emergency management resources. The council emphasized the importance of being prepared for potential disasters, particularly in light of recent severe weather events affecting other regions.

Overall, the meeting underscored Lake Jackson's commitment to fiscal responsibility while ensuring that residents continue to receive quality services without the burden of excessive taxation. The council's decisions reflect a balanced approach to managing the city's financial health and community needs.

The council discussed maintaining the Maintenance and Operations (M&O) tax rate at 0.02, which will result in a decrease in tax revenue for the upcoming year. Additionally, a modest increase in the proposed sales tax was approved, alongside a reduction of $50,000 in the 380 agreement. The recommended debt service tax rate is set at 0.378911, which remains lower than neighboring cities in Brazoria County, countering misconceptions about high local taxes.

The council also called for a public hearing to discuss the proposed budget and tax rate of 0.39484 per $100, scheduled for August 18, 2025. This meeting will provide an opportunity for residents to engage with council members about the fiscal plans for the upcoming year.

In other discussions, updates on emergency preparedness were highlighted, showcasing improvements to the city's emergency management resources. The council emphasized the importance of being prepared for potential disasters, particularly in light of recent severe weather events affecting other regions.

Overall, the meeting underscored Lake Jackson's commitment to fiscal responsibility while ensuring that residents continue to receive quality services without the burden of excessive taxation. The council's decisions reflect a balanced approach to managing the city's financial health and community needs.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting