Lakeway City Council reviews budget challenges and impacts of slowing growth on tax rates

August 04, 2025 | Lakeway, Travis County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

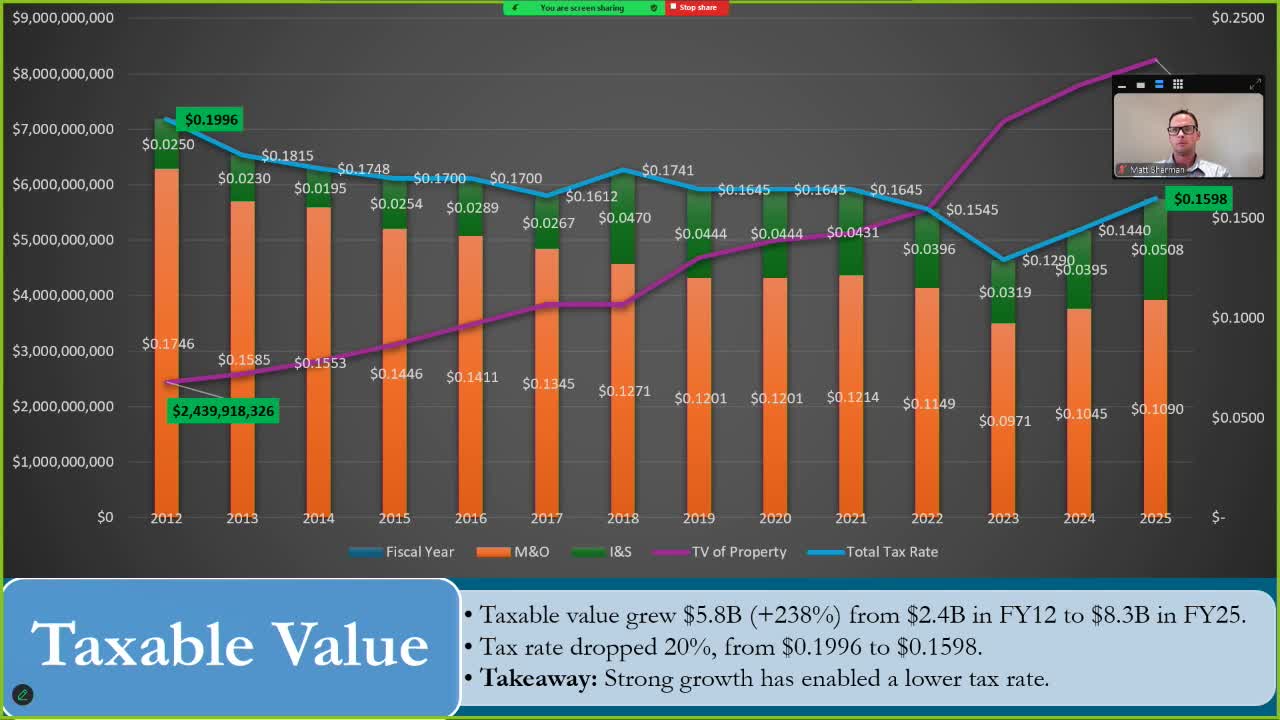

Lakeway City Council members highlighted significant financial trends during their recent meeting, revealing a complex picture of the city's fiscal health. Over the past 15 years, Lakeway has seen a remarkable increase in taxable property values, totaling approximately $5.8 billion. This growth has allowed the city to lower its overall tax rate by about 20%, a move aimed at ensuring responsible use of taxpayer money.

However, the council also noted a concerning trend: the ratio of maintenance and operations (M&O) funding to debt service (I&S) is shrinking. As the city takes on new bonds for transportation and parks, the burden of debt is rising, while funding for essential services is decreasing. This shift raises questions about the sustainability of the city's budget, especially as growth in new property development has slowed significantly, dropping to less than half a percent in recent years.

The council discussed the implications of state legislation that could further restrict the city's ability to raise revenue. Current proposals could lower the cap on tax rate increases from 3.5% to 2.5%, which would not keep pace with inflation and could hinder the city's financial flexibility.

Despite these challenges, city officials remain optimistic about future projects, particularly the anticipated development of a new city center, which is expected to stimulate growth in the coming years. However, the council acknowledged that the days of rapid growth may be behind them, necessitating a reevaluation of financial strategies moving forward.

As Lakeway navigates these fiscal challenges, the council's commitment to maintaining a balanced budget remains strong, with a focus on ensuring that taxpayer interests are prioritized in all financial decisions.

However, the council also noted a concerning trend: the ratio of maintenance and operations (M&O) funding to debt service (I&S) is shrinking. As the city takes on new bonds for transportation and parks, the burden of debt is rising, while funding for essential services is decreasing. This shift raises questions about the sustainability of the city's budget, especially as growth in new property development has slowed significantly, dropping to less than half a percent in recent years.

The council discussed the implications of state legislation that could further restrict the city's ability to raise revenue. Current proposals could lower the cap on tax rate increases from 3.5% to 2.5%, which would not keep pace with inflation and could hinder the city's financial flexibility.

Despite these challenges, city officials remain optimistic about future projects, particularly the anticipated development of a new city center, which is expected to stimulate growth in the coming years. However, the council acknowledged that the days of rapid growth may be behind them, necessitating a reevaluation of financial strategies moving forward.

As Lakeway navigates these fiscal challenges, the council's commitment to maintaining a balanced budget remains strong, with a focus on ensuring that taxpayer interests are prioritized in all financial decisions.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting