City airport bond sale achieves positive outlook and lowers interest rates to 5.16%

July 29, 2025 | Houston, Harris County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

In a recent meeting focused on budget and fiscal affairs, Houston officials highlighted significant financial developments that promise to enhance the city’s infrastructure and economic growth. A key takeaway was the positive shift in the airport's bond rating outlook, which moved from stable to positive. This change reflects the ongoing transformation and economic development at the airport, which is expected to benefit the local community.

The city successfully sold approximately $700 million in bonds, achieving a reduced interest rate of 5.16%, down from an initial target of 5.39%. This reduction in borrowing costs is anticipated to free up funds for additional improvements, directly impacting public services and infrastructure projects.

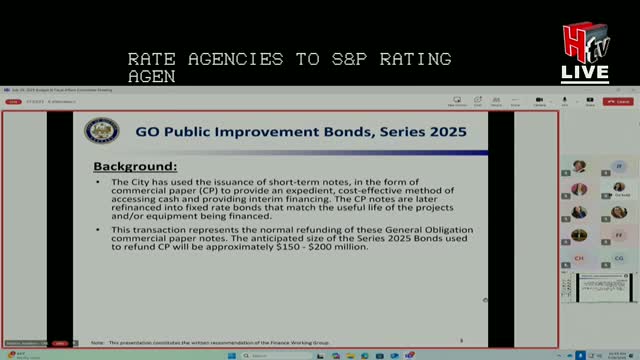

Upcoming transactions include the issuance of general obligation public improvement bonds, projected to range between $150 million and $200 million. These bonds will support essential city departments such as fire, police, parks, and libraries. The financing strategy involves using commercial paper for interim funding, which will later be converted into long-term fixed-rate bonds.

Additionally, the city plans to address cash flow gaps through tax and revenue anticipation notes, which will be authorized in August. This short-term borrowing is crucial as it aligns with the timing of property tax revenues, ensuring that the city can meet its financial obligations throughout the year.

The meeting also discussed significant loans from the Texas Water Development Board (TWDB) aimed at financing critical water infrastructure projects. The city is seeking $966 million in loans for the East Water Purification Plant, with the first installment expected to be around $350 million. These loans will leverage the TWDB's high credit rating to lower financing costs, ultimately benefiting the utility system and residents.

Moreover, plans for refinancing existing bonds could yield savings of approximately $14.7 million, further enhancing the city’s financial health. The council is expected to consider these refinancing options in the fall.

As Houston continues to navigate its fiscal landscape, these financial strategies and upcoming projects are poised to strengthen the city’s infrastructure and improve services for its residents, demonstrating a commitment to responsible fiscal management and community development.

The city successfully sold approximately $700 million in bonds, achieving a reduced interest rate of 5.16%, down from an initial target of 5.39%. This reduction in borrowing costs is anticipated to free up funds for additional improvements, directly impacting public services and infrastructure projects.

Upcoming transactions include the issuance of general obligation public improvement bonds, projected to range between $150 million and $200 million. These bonds will support essential city departments such as fire, police, parks, and libraries. The financing strategy involves using commercial paper for interim funding, which will later be converted into long-term fixed-rate bonds.

Additionally, the city plans to address cash flow gaps through tax and revenue anticipation notes, which will be authorized in August. This short-term borrowing is crucial as it aligns with the timing of property tax revenues, ensuring that the city can meet its financial obligations throughout the year.

The meeting also discussed significant loans from the Texas Water Development Board (TWDB) aimed at financing critical water infrastructure projects. The city is seeking $966 million in loans for the East Water Purification Plant, with the first installment expected to be around $350 million. These loans will leverage the TWDB's high credit rating to lower financing costs, ultimately benefiting the utility system and residents.

Moreover, plans for refinancing existing bonds could yield savings of approximately $14.7 million, further enhancing the city’s financial health. The council is expected to consider these refinancing options in the fall.

As Houston continues to navigate its fiscal landscape, these financial strategies and upcoming projects are poised to strengthen the city’s infrastructure and improve services for its residents, demonstrating a commitment to responsible fiscal management and community development.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting