Congress Explores Crop Insurance and Tax Incentives for Middle-Class Families

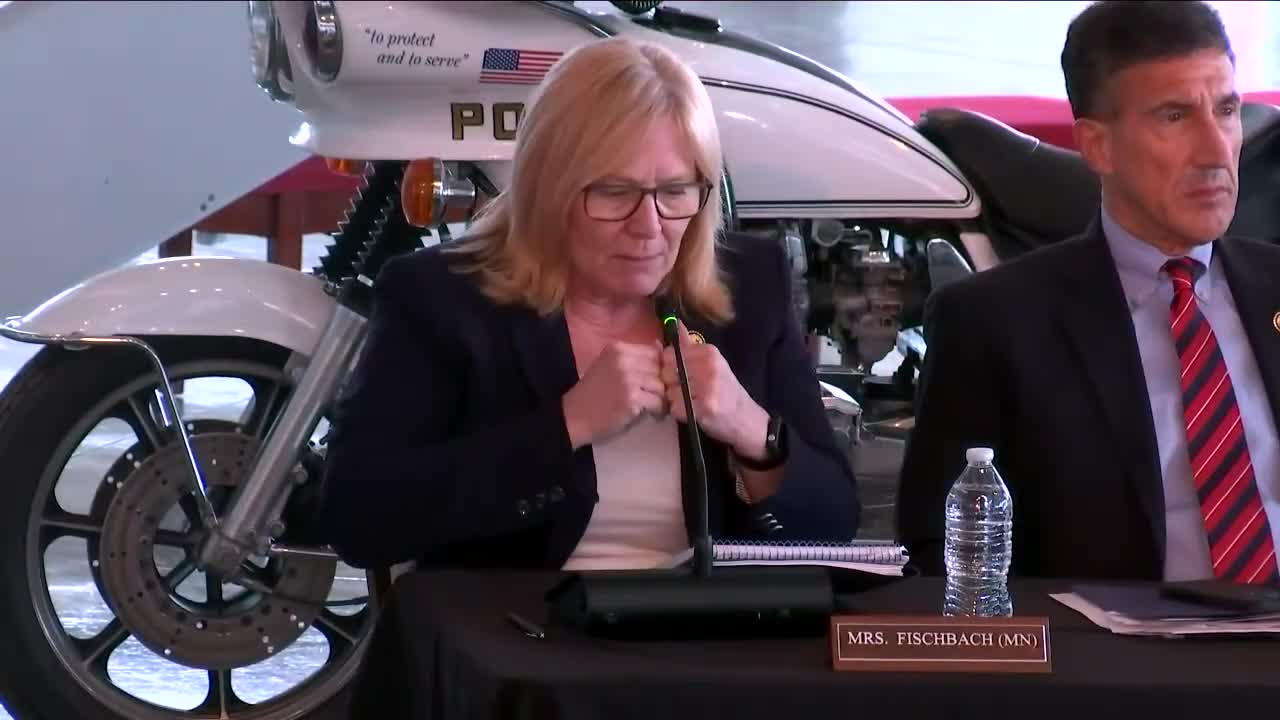

July 27, 2025 | Ways and Means: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

During a recent meeting of the U.S. House Committee on Ways & Means, significant discussions centered around the proposed "One, Big, Beautiful Bill" aimed at bolstering the American economy. Key highlights included enhancements to the crop insurance program and tax incentives designed to support small businesses and middle-class families.

One of the standout features of the bill is the improvement to the crop insurance program, which is expected to provide farmers with better financial security. This enhancement is crucial as it addresses the challenges faced by the agricultural sector, particularly in times of economic uncertainty.

Additionally, the bill proposes tax incentives, including an expanded child tax credit, which advocates argue will greatly benefit families and stimulate economic growth. Committee members emphasized the importance of promoting these incentives to ensure that the public understands their potential impact on both businesses and households.

The meeting also touched on the rising prices of beef, with discussions highlighting the disconnect between retail prices and what farmers receive for their cattle. While consumers are facing prices around $9 per pound, farmers reported selling live cattle for approximately $3 per pound, raising concerns about market dynamics and profitability for producers.

As the committee moves forward, the implications of these discussions could lead to significant changes in economic policy that directly affect American families and businesses. The focus remains on ensuring that the benefits of the proposed bill are communicated effectively to the public, paving the way for a more robust economic future.

One of the standout features of the bill is the improvement to the crop insurance program, which is expected to provide farmers with better financial security. This enhancement is crucial as it addresses the challenges faced by the agricultural sector, particularly in times of economic uncertainty.

Additionally, the bill proposes tax incentives, including an expanded child tax credit, which advocates argue will greatly benefit families and stimulate economic growth. Committee members emphasized the importance of promoting these incentives to ensure that the public understands their potential impact on both businesses and households.

The meeting also touched on the rising prices of beef, with discussions highlighting the disconnect between retail prices and what farmers receive for their cattle. While consumers are facing prices around $9 per pound, farmers reported selling live cattle for approximately $3 per pound, raising concerns about market dynamics and profitability for producers.

As the committee moves forward, the implications of these discussions could lead to significant changes in economic policy that directly affect American families and businesses. The focus remains on ensuring that the benefits of the proposed bill are communicated effectively to the public, paving the way for a more robust economic future.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting