Ranchers and Small Business Owners Advocate for Tax Benefits in Congressional Hearing

July 27, 2025 | Ways and Means: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

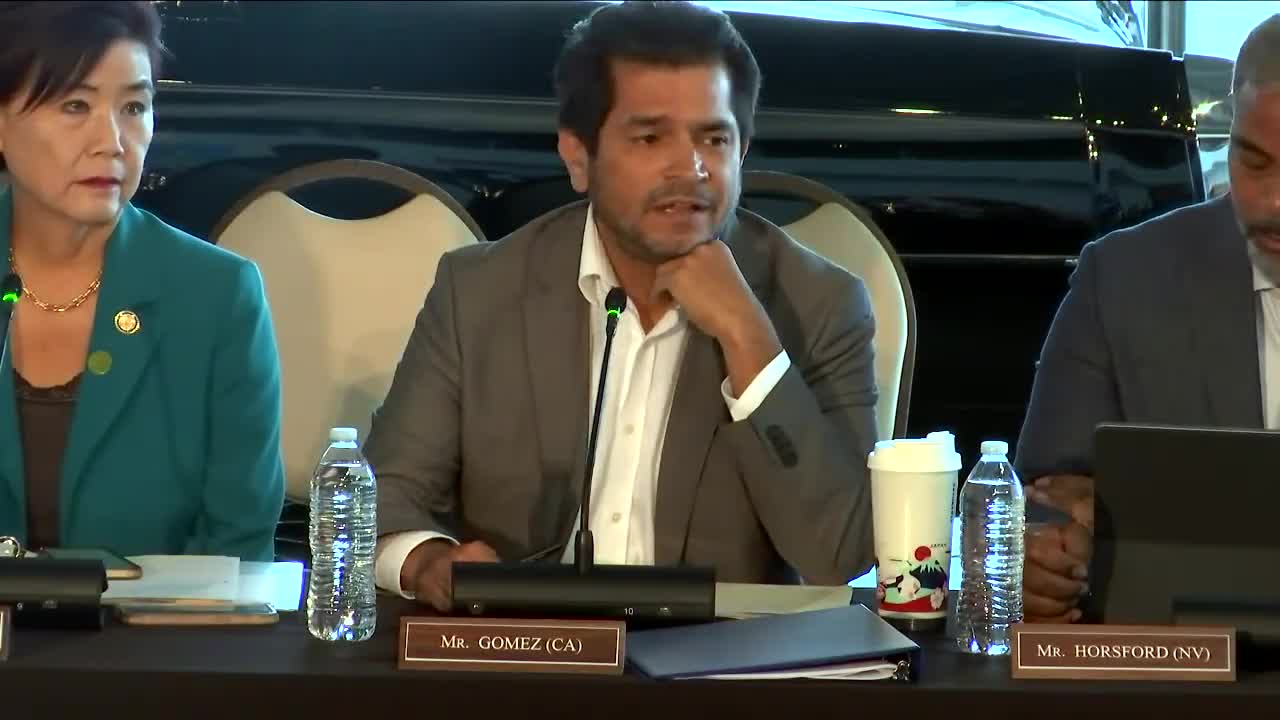

In a recent meeting of the U.S. House Committee on Ways & Means, key stakeholders from various sectors gathered to discuss the implications of the proposed "One, Big, Beautiful Bill," which aims to bolster the American economy through significant tax reforms. The discussions highlighted how these changes could directly benefit small businesses and family-owned farms across the nation.

Kevin Koester, a fifth-generation rancher and representative of the National Cattlemen's Beef Association, emphasized the importance of the bill's provisions for cattle producers. He expressed gratitude for the long-term relief from the death tax, which he noted could have devastating effects on family farms. Koester shared that many ranchers would have faced severe financial burdens if the death tax had reverted to previous levels, potentially forcing them to sell land critical for food production. He underscored that the permanence of the small business deduction and the restoration of bonus depreciation would empower ranchers to invest in their operations and compete effectively against larger corporations.

Raymond Huff, president of HJB Convenience, also spoke about the bill's potential to revitalize small businesses. After facing significant challenges during the COVID-19 pandemic, Huff highlighted how tax provisions, such as 100% bonus depreciation, would enable him to expand his convenience store operations and hire more employees. He projected that these changes could lead to a 50% increase in his workforce, illustrating the broader economic impact that similar provisions could have across the country.

Will Fulton, vice president of business development at Robinson Helicopter, added to the conversation by discussing the importance of American manufacturing. He noted that the bill's support for manufacturers would help sustain jobs and promote growth in the aerospace sector, particularly as the company competes for government contracts.

The testimonies from these industry leaders reflect a shared optimism about the bill's potential to create a more favorable environment for small businesses and family farms. By addressing tax burdens and providing incentives for investment, the proposed legislation aims to foster economic growth and stability in communities nationwide.

As the committee continues to deliberate on the bill, the voices of those directly impacted by these policies underscore the critical connection between government action and the livelihoods of American families. The outcomes of this meeting could shape the future of small businesses and agriculture, reinforcing the need for policies that support local economies and promote sustainable growth.

Kevin Koester, a fifth-generation rancher and representative of the National Cattlemen's Beef Association, emphasized the importance of the bill's provisions for cattle producers. He expressed gratitude for the long-term relief from the death tax, which he noted could have devastating effects on family farms. Koester shared that many ranchers would have faced severe financial burdens if the death tax had reverted to previous levels, potentially forcing them to sell land critical for food production. He underscored that the permanence of the small business deduction and the restoration of bonus depreciation would empower ranchers to invest in their operations and compete effectively against larger corporations.

Raymond Huff, president of HJB Convenience, also spoke about the bill's potential to revitalize small businesses. After facing significant challenges during the COVID-19 pandemic, Huff highlighted how tax provisions, such as 100% bonus depreciation, would enable him to expand his convenience store operations and hire more employees. He projected that these changes could lead to a 50% increase in his workforce, illustrating the broader economic impact that similar provisions could have across the country.

Will Fulton, vice president of business development at Robinson Helicopter, added to the conversation by discussing the importance of American manufacturing. He noted that the bill's support for manufacturers would help sustain jobs and promote growth in the aerospace sector, particularly as the company competes for government contracts.

The testimonies from these industry leaders reflect a shared optimism about the bill's potential to create a more favorable environment for small businesses and family farms. By addressing tax burdens and providing incentives for investment, the proposed legislation aims to foster economic growth and stability in communities nationwide.

As the committee continues to deliberate on the bill, the voices of those directly impacted by these policies underscore the critical connection between government action and the livelihoods of American families. The outcomes of this meeting could shape the future of small businesses and agriculture, reinforcing the need for policies that support local economies and promote sustainable growth.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting