Congressional Hearing at Reagan Library Highlights Tax Bill Debate and Economic Impacts

July 27, 2025 | Ways and Means: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

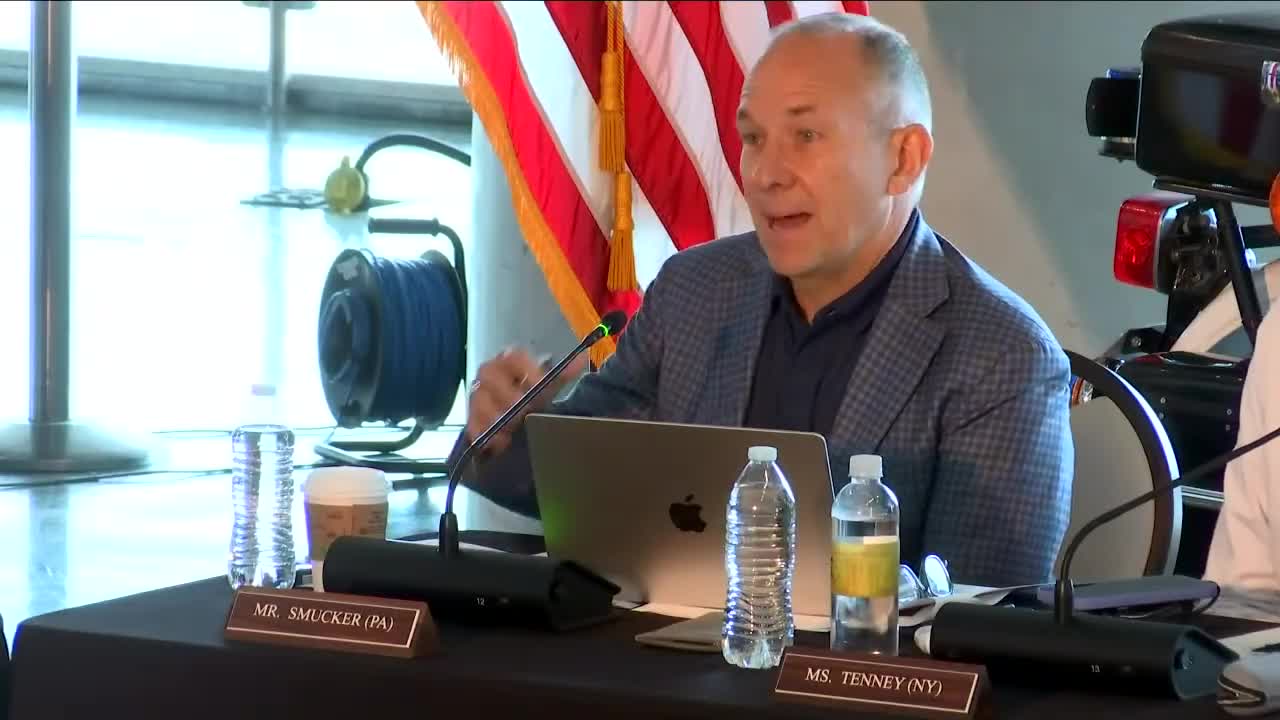

In a recent meeting held at the Ronald Reagan Presidential Library, the U.S. House Committee on Ways & Means convened to discuss the implications of the proposed "One, Big, Beautiful Bill" aimed at revitalizing the American economy. The hearing highlighted contrasting perspectives on the bill's potential impact on various income groups and the overall economic landscape.

A significant point of contention arose regarding tax relief distribution. Republican representatives argued that the bill would foster economic growth and benefit all Americans, citing historical precedents from the Reagan administration. They emphasized that tax cuts could lead to increased job creation and wage growth, referencing a period of substantial GDP growth during Reagan's presidency. Proponents of the bill asserted that it would empower the American people by reducing government intervention and promoting free-market principles.

Conversely, Democratic members of the committee raised concerns about the bill's fairness, particularly regarding its benefits for high-income earners compared to lower-income individuals. They pointed to studies indicating that the majority of tax relief would disproportionately favor the wealthiest Americans, potentially exacerbating income inequality. Critics argued that while corporations might receive permanent tax cuts, working-class Americans would see only temporary benefits, leading to a system that favors the affluent.

The discussion also touched on the importance of certainty for businesses, with some witnesses highlighting that the permanence of certain tax provisions would encourage investment and job creation. However, concerns were voiced about the potential long-term fiscal implications of the bill, with estimates suggesting it could significantly increase the national deficit.

As the committee continues to deliberate on the bill, the contrasting viewpoints underscore the ongoing debate about the best approach to stimulate economic growth while ensuring equitable benefits for all Americans. The outcome of this legislation could have lasting effects on the economy, particularly for working-class families and small businesses. The committee's next steps will be crucial in determining how these discussions translate into policy.

A significant point of contention arose regarding tax relief distribution. Republican representatives argued that the bill would foster economic growth and benefit all Americans, citing historical precedents from the Reagan administration. They emphasized that tax cuts could lead to increased job creation and wage growth, referencing a period of substantial GDP growth during Reagan's presidency. Proponents of the bill asserted that it would empower the American people by reducing government intervention and promoting free-market principles.

Conversely, Democratic members of the committee raised concerns about the bill's fairness, particularly regarding its benefits for high-income earners compared to lower-income individuals. They pointed to studies indicating that the majority of tax relief would disproportionately favor the wealthiest Americans, potentially exacerbating income inequality. Critics argued that while corporations might receive permanent tax cuts, working-class Americans would see only temporary benefits, leading to a system that favors the affluent.

The discussion also touched on the importance of certainty for businesses, with some witnesses highlighting that the permanence of certain tax provisions would encourage investment and job creation. However, concerns were voiced about the potential long-term fiscal implications of the bill, with estimates suggesting it could significantly increase the national deficit.

As the committee continues to deliberate on the bill, the contrasting viewpoints underscore the ongoing debate about the best approach to stimulate economic growth while ensuring equitable benefits for all Americans. The outcome of this legislation could have lasting effects on the economy, particularly for working-class families and small businesses. The committee's next steps will be crucial in determining how these discussions translate into policy.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting