Solar For All Program Faces Urgency Ahead Of Federal Tax Credit Deadline

July 19, 2025 | Public Utilities Commission (PUC), Executive , Hawaii

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

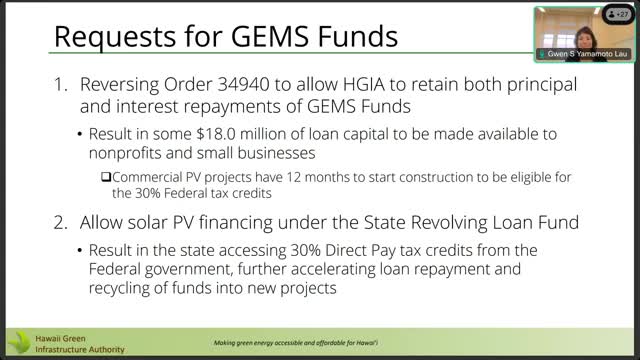

The GEMS Status Conference with the Hawaii Green Infrastructure Authority (HGIA) convened on July 19, 2025, to discuss critical updates regarding the Green Energy Market Securitization (GEMS) program. The meeting focused on the urgency of project timelines, funding allocations, and the implications of recent changes to federal tax credits for solar energy projects.

The conference began with a discussion on the direct pay benefit associated with federal funding, which is set to be reduced for projects that do not commence construction by July 4, 2026. Participants emphasized the urgency for projects to secure funding and begin construction to maximize the benefits of the 30% federal tax credit. The managing director of HGIA highlighted the need to expedite commitments for community solar projects, noting that the recent legislative changes have intensified the urgency to move projects forward.

A significant portion of the meeting was dedicated to the status of applications for direct financing. Currently, there are 60 applications from individual households and 408 from third-party entities. The urgency to process these applications was underscored, as many applicants aim to claim federal tax credits that require substantial project completion by the end of the year. The HGIA team is actively monitoring these applications to ensure timely processing, with a focus on helping applicants secure their tax credits.

The discussion also touched on the potential for additional funding to assist with urgent applications. It was noted that if more funds became available, it could significantly aid in addressing the backlog of applications and support new applicants seeking financing.

As the meeting progressed, participants explored the impact of the changing landscape of tax credits on the GEMS program's deployment strategy. The managing director indicated that while the residential solar tax credit is phasing out, there is a longer runway for commercial projects and third-party residential ownership. The focus may shift towards these areas, particularly for low-income households who may not benefit from tax credits due to lack of tax liability.

In conclusion, the GEMS Status Conference highlighted the pressing need for timely project initiation to leverage federal funding and tax credits. The HGIA is committed to processing applications efficiently and adapting its strategy to ensure that the benefits of solar energy financing are accessible to all residents, particularly those in lower-income brackets. The next steps will involve continued monitoring of applications and potential adjustments to funding allocations to meet the evolving needs of the community.

The conference began with a discussion on the direct pay benefit associated with federal funding, which is set to be reduced for projects that do not commence construction by July 4, 2026. Participants emphasized the urgency for projects to secure funding and begin construction to maximize the benefits of the 30% federal tax credit. The managing director of HGIA highlighted the need to expedite commitments for community solar projects, noting that the recent legislative changes have intensified the urgency to move projects forward.

A significant portion of the meeting was dedicated to the status of applications for direct financing. Currently, there are 60 applications from individual households and 408 from third-party entities. The urgency to process these applications was underscored, as many applicants aim to claim federal tax credits that require substantial project completion by the end of the year. The HGIA team is actively monitoring these applications to ensure timely processing, with a focus on helping applicants secure their tax credits.

The discussion also touched on the potential for additional funding to assist with urgent applications. It was noted that if more funds became available, it could significantly aid in addressing the backlog of applications and support new applicants seeking financing.

As the meeting progressed, participants explored the impact of the changing landscape of tax credits on the GEMS program's deployment strategy. The managing director indicated that while the residential solar tax credit is phasing out, there is a longer runway for commercial projects and third-party residential ownership. The focus may shift towards these areas, particularly for low-income households who may not benefit from tax credits due to lack of tax liability.

In conclusion, the GEMS Status Conference highlighted the pressing need for timely project initiation to leverage federal funding and tax credits. The HGIA is committed to processing applications efficiently and adapting its strategy to ensure that the benefits of solar energy financing are accessible to all residents, particularly those in lower-income brackets. The next steps will involve continued monitoring of applications and potential adjustments to funding allocations to meet the evolving needs of the community.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting