Indian River County outlines new property tax rates and budget adjustments

July 09, 2025 | Indian River County, Florida

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

In a recent budget workshop held by the Indian River County Board of County Commissioners, officials discussed the proposed fiscal year budget, highlighting significant changes in property tax assessments and funding allocations. The meeting, which took place on July 9, 2025, focused on the implications of the assessed property values and the resulting tax rates for residents.

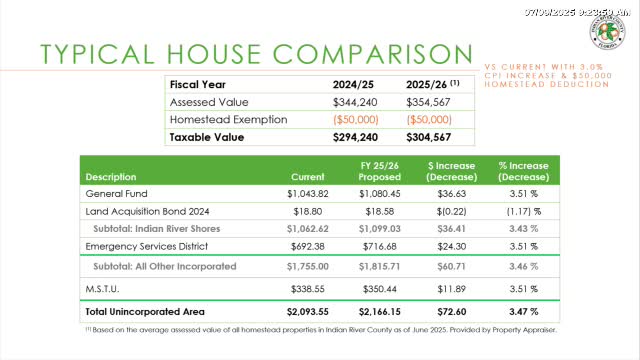

The average assessed value of properties in the county was reported at $354,567. After applying the standard $50,000 homestead exemption, the taxable value for homeowners would be approximately $304,567. This calculation indicates that homeowners would see a slight increase in their property tax bills, with an estimated rise of $36.63, bringing the total to about $1,043.82 for the year. For residents in Indian River Shores, the increase would be around 3.43%, while those in unincorporated areas would experience a 3.51% increase in emergency services district levies.

The budget workshop also revealed that the general fund is projected to see an 8.8% increase in ad valorem tax revenue, amounting to approximately $8.68 million. This increase is attributed to a combination of rising property values and a consistent millage rate of 3.5475, which has remained unchanged for six consecutive years. However, it is important to note that maintaining this rate is technically classified as a tax increase since it exceeds the rollback rate, which is designed to generate the same revenue as the previous year adjusted for property value changes.

Additionally, the budget includes a 5.2% increase in funding for constitutional officers and a notable 13.8% increase for children's services, reflecting the growing demand for these essential services. The meeting underscored the reliance on property taxes, which constitute 72% of the general fund revenue, raising concerns about the county's financial sustainability amid potential state funding changes.

As the county prepares for the upcoming fiscal year, the discussions highlighted the delicate balance between maintaining essential services and managing the financial burden on residents. The Board of County Commissioners will continue to deliberate on these budget proposals, with final decisions expected in the coming weeks.

The average assessed value of properties in the county was reported at $354,567. After applying the standard $50,000 homestead exemption, the taxable value for homeowners would be approximately $304,567. This calculation indicates that homeowners would see a slight increase in their property tax bills, with an estimated rise of $36.63, bringing the total to about $1,043.82 for the year. For residents in Indian River Shores, the increase would be around 3.43%, while those in unincorporated areas would experience a 3.51% increase in emergency services district levies.

The budget workshop also revealed that the general fund is projected to see an 8.8% increase in ad valorem tax revenue, amounting to approximately $8.68 million. This increase is attributed to a combination of rising property values and a consistent millage rate of 3.5475, which has remained unchanged for six consecutive years. However, it is important to note that maintaining this rate is technically classified as a tax increase since it exceeds the rollback rate, which is designed to generate the same revenue as the previous year adjusted for property value changes.

Additionally, the budget includes a 5.2% increase in funding for constitutional officers and a notable 13.8% increase for children's services, reflecting the growing demand for these essential services. The meeting underscored the reliance on property taxes, which constitute 72% of the general fund revenue, raising concerns about the county's financial sustainability amid potential state funding changes.

As the county prepares for the upcoming fiscal year, the discussions highlighted the delicate balance between maintaining essential services and managing the financial burden on residents. The Board of County Commissioners will continue to deliberate on these budget proposals, with final decisions expected in the coming weeks.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting