Anna City Council proposes property tax exemption for 125000 business property value

July 08, 2025 | Anna, Collin County, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

The City Council of Anna convened on July 8, 2025, to discuss several key agenda items focused on economic development and property tax adjustments.

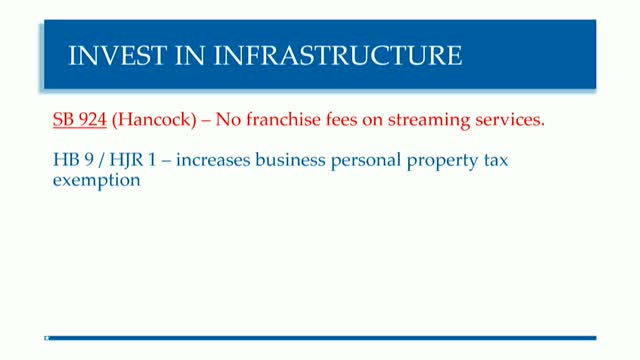

One significant proposal discussed was a property tax exemption aimed at supporting local businesses. If approved, this exemption would allow for a reduction of property taxes on up to $125,000 of the market value of tangible business personal property. This marks a substantial increase from the previous threshold, which was set at less than $2,500 of taxable value. The new exemption is set to take effect on January 1, aligning with the upcoming budget considerations.

Additionally, the council highlighted collaborative efforts with state representatives, specifically Representative Leach and Senator Paxton, to establish qualified hotel projects within the city. This initiative is part of a broader strategy to enhance economic development in Anna.

Overall, the meeting underscored the city's commitment to fostering a favorable business environment while preparing for the upcoming budget cycle. Further discussions and decisions regarding these proposals are expected in future meetings.

One significant proposal discussed was a property tax exemption aimed at supporting local businesses. If approved, this exemption would allow for a reduction of property taxes on up to $125,000 of the market value of tangible business personal property. This marks a substantial increase from the previous threshold, which was set at less than $2,500 of taxable value. The new exemption is set to take effect on January 1, aligning with the upcoming budget considerations.

Additionally, the council highlighted collaborative efforts with state representatives, specifically Representative Leach and Senator Paxton, to establish qualified hotel projects within the city. This initiative is part of a broader strategy to enhance economic development in Anna.

Overall, the meeting underscored the city's commitment to fostering a favorable business environment while preparing for the upcoming budget cycle. Further discussions and decisions regarding these proposals are expected in future meetings.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting