US equities rebound as non-US markets outperform in Q1 investment report

June 28, 2025 | St. Mary's County, Maryland

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

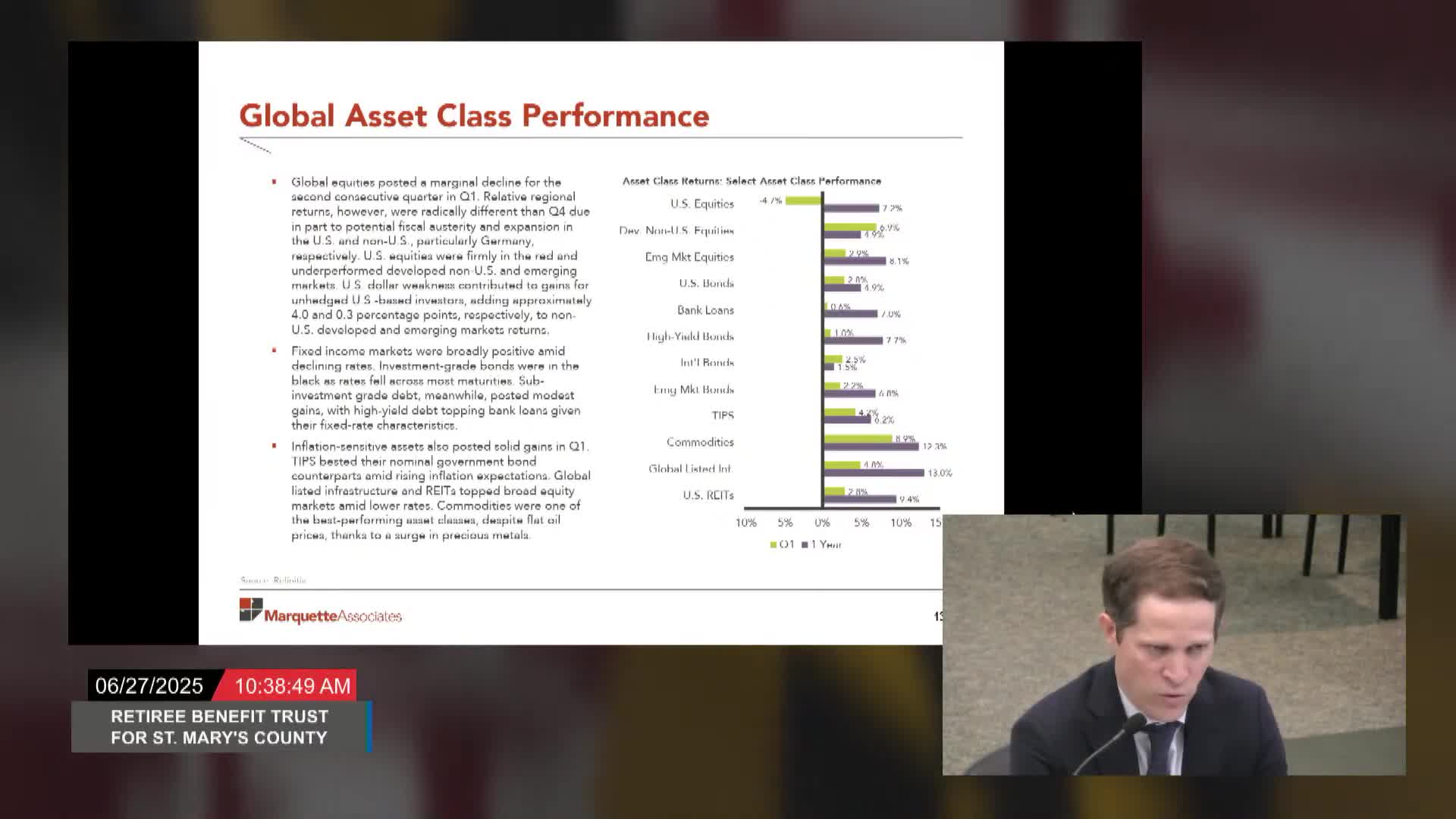

St. Mary's County's Retiree Benefit Trust (OPEB) reported a positive investment change of approximately $800,000 for the first quarter of 2025, reflecting a return of 0.7%, which outperformed its policy index by 30 basis points. This gain comes amid a challenging environment for U.S. equities, which saw a decline of nearly 5%. In contrast, developed non-U.S. and emerging market equities posted impressive returns of about 7.3% and 7%, respectively, aided by a weaker U.S. dollar that enhanced returns for U.S.-based investors.

The meeting highlighted the importance of diversification within the trust, as most asset classes outside U.S. equities experienced gains. U.S. bonds also performed well, yielding around 3% due to market expectations of interest rate cuts, which increased bond prices. The trust's allocation to various sectors proved beneficial, particularly as active equity managers navigated the market dynamics effectively.

Despite the overall positive performance, the trust's exposure to U.S. equities, particularly large-cap growth stocks, negatively impacted returns. The meeting noted that sectors like communication services and consumer discretionary lagged significantly, primarily due to the underperformance of major tech stocks. However, smaller and mid-cap managers, such as John Hancock, performed well by avoiding speculative investments that suffered during the quarter.

Looking ahead, the trust is expected to continue its strong performance, with projections indicating a potential return of around 11% for the fiscal year, surpassing the assumed rate of return. The board plans to provide further updates on private market valuations in upcoming meetings, which could further enhance the trust's performance metrics. Overall, the discussions underscored the trust's resilience and strategic positioning in a volatile market landscape.

The meeting highlighted the importance of diversification within the trust, as most asset classes outside U.S. equities experienced gains. U.S. bonds also performed well, yielding around 3% due to market expectations of interest rate cuts, which increased bond prices. The trust's allocation to various sectors proved beneficial, particularly as active equity managers navigated the market dynamics effectively.

Despite the overall positive performance, the trust's exposure to U.S. equities, particularly large-cap growth stocks, negatively impacted returns. The meeting noted that sectors like communication services and consumer discretionary lagged significantly, primarily due to the underperformance of major tech stocks. However, smaller and mid-cap managers, such as John Hancock, performed well by avoiding speculative investments that suffered during the quarter.

Looking ahead, the trust is expected to continue its strong performance, with projections indicating a potential return of around 11% for the fiscal year, surpassing the assumed rate of return. The board plans to provide further updates on private market valuations in upcoming meetings, which could further enhance the trust's performance metrics. Overall, the discussions underscored the trust's resilience and strategic positioning in a volatile market landscape.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting