Investment committee proposes major rebalancing of $126M fund assets

June 28, 2025 | St. Mary's County, Maryland

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

In the heart of St. Mary's County, a pivotal government meeting unfolded, focusing on the Retiree Benefit Trust (OPEB) and its financial strategies. As officials gathered, the atmosphere buzzed with anticipation over the trust's performance and future direction.

The meeting revealed that the total assets of the trust have reached approximately $126 million, marking a significant increase of about $2.5 million since the end of the first quarter. This growth was attributed to a reimbursement of around $1.2 million, alongside an investment change that has seen an uptick of about $4 million in recent weeks.

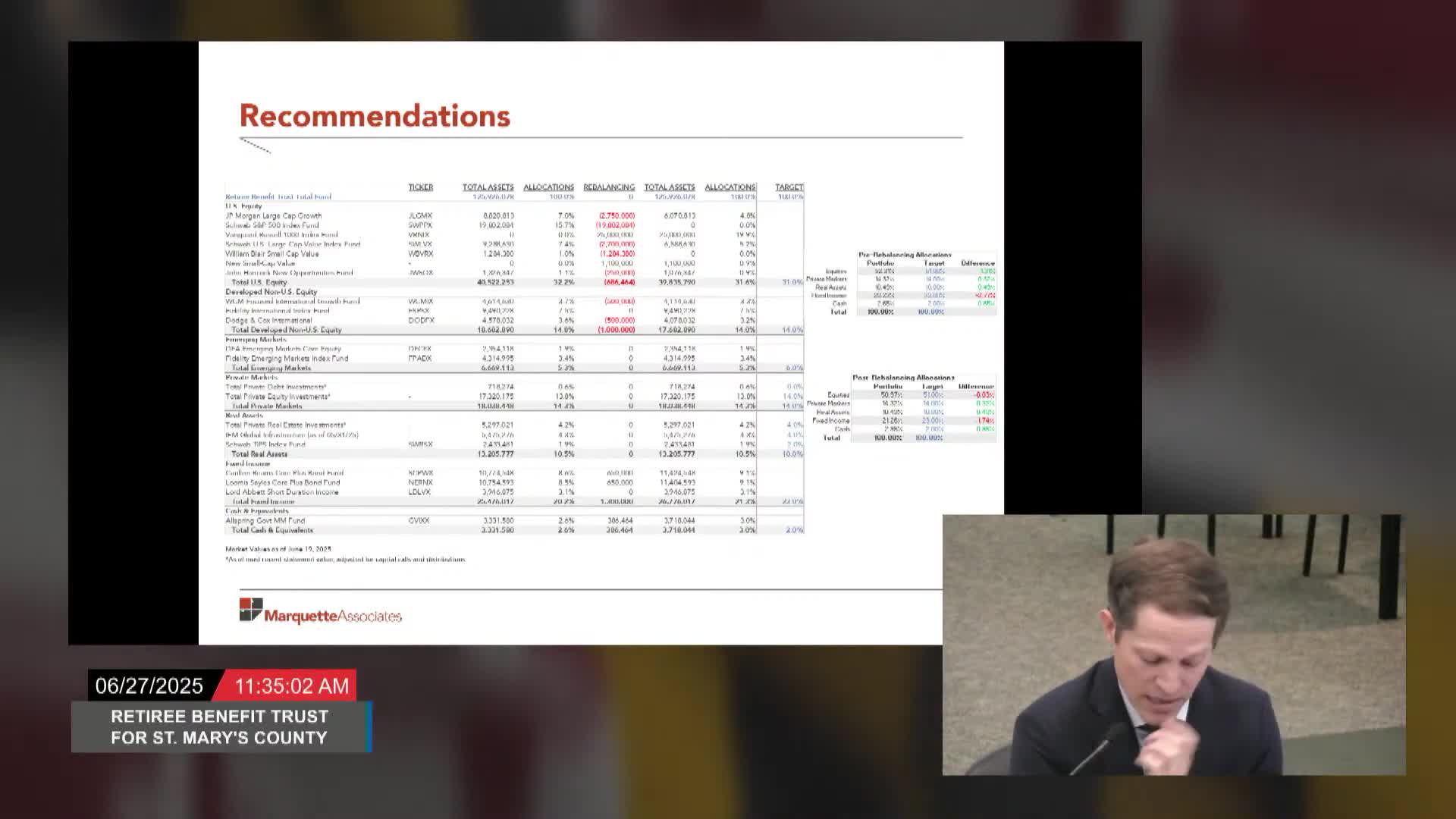

Central to the discussions was the rebalancing of the trust's portfolio. Officials proposed a series of strategic adjustments aimed at aligning investments with new management targets. A partial redemption of $2.7 million from JPMorgan was recommended, which would reduce its share in the overall fund from 7% to just under 5%. Additionally, a full liquidation of Schwab's holdings, amounting to $525,000, was suggested, with funds redirected into the Vanguard Russell 1 index.

The meeting also highlighted the importance of trimming investments in non-US equities, which have experienced substantial gains this year. A proposed reduction of $500 each from WCM and Dodge & Cox was discussed, with the intention of reallocating those funds into fixed income investments.

As the meeting progressed, officials emphasized a cautious approach to cash management. With plans to withdraw about $1.2 million quarterly, the trust aims to maintain a buffer of approximately $3.7 million in cash reserves after executing the proposed changes.

The discussions underscored a commitment to prudent financial stewardship, ensuring that the Retiree Benefit Trust remains robust and well-positioned to meet the needs of its beneficiaries in the years to come. As the meeting concluded, the board's decisions would pave the way for a more strategically aligned investment portfolio, reflecting both current market conditions and future financial goals.

The meeting revealed that the total assets of the trust have reached approximately $126 million, marking a significant increase of about $2.5 million since the end of the first quarter. This growth was attributed to a reimbursement of around $1.2 million, alongside an investment change that has seen an uptick of about $4 million in recent weeks.

Central to the discussions was the rebalancing of the trust's portfolio. Officials proposed a series of strategic adjustments aimed at aligning investments with new management targets. A partial redemption of $2.7 million from JPMorgan was recommended, which would reduce its share in the overall fund from 7% to just under 5%. Additionally, a full liquidation of Schwab's holdings, amounting to $525,000, was suggested, with funds redirected into the Vanguard Russell 1 index.

The meeting also highlighted the importance of trimming investments in non-US equities, which have experienced substantial gains this year. A proposed reduction of $500 each from WCM and Dodge & Cox was discussed, with the intention of reallocating those funds into fixed income investments.

As the meeting progressed, officials emphasized a cautious approach to cash management. With plans to withdraw about $1.2 million quarterly, the trust aims to maintain a buffer of approximately $3.7 million in cash reserves after executing the proposed changes.

The discussions underscored a commitment to prudent financial stewardship, ensuring that the Retiree Benefit Trust remains robust and well-positioned to meet the needs of its beneficiaries in the years to come. As the meeting concluded, the board's decisions would pave the way for a more strategically aligned investment portfolio, reflecting both current market conditions and future financial goals.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting