City officials push to access $3.6 million federal reimbursement funds

June 19, 2025 | Waukesha City, Waukesha County, Wisconsin

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

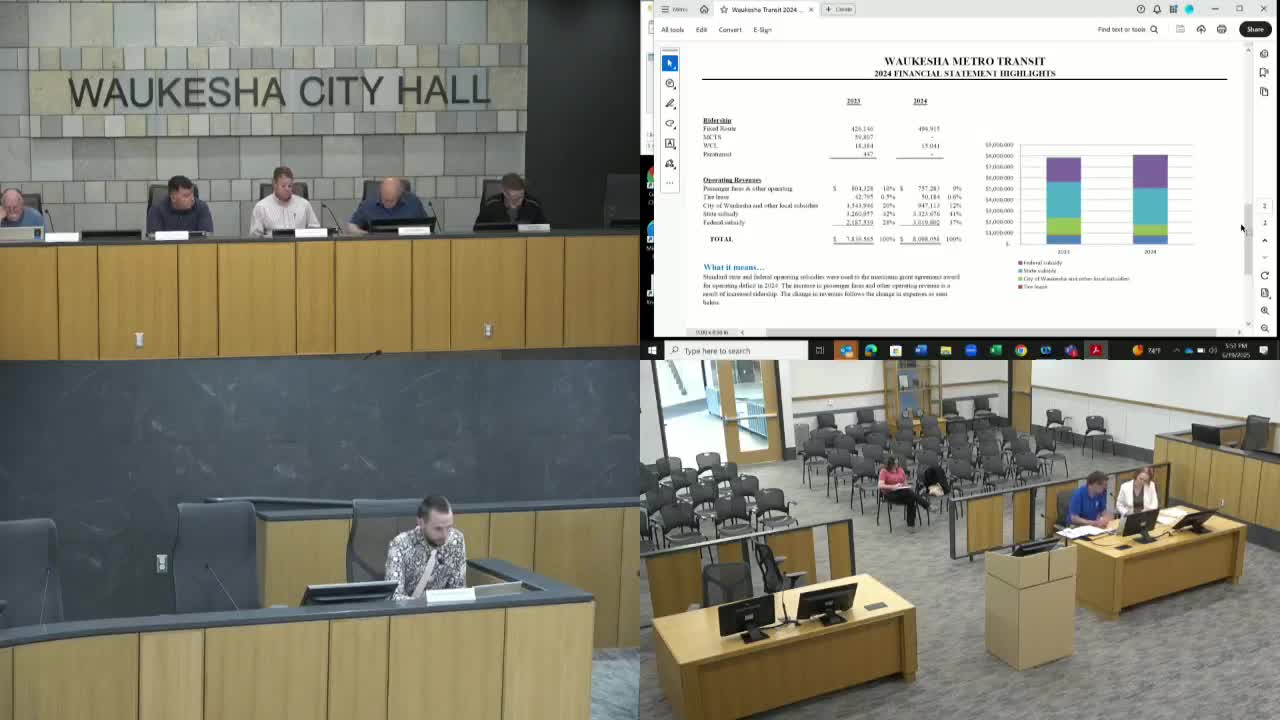

During the recent Transit Commission meeting in Waukesha, significant discussions centered around the management of federal and state funds, particularly a notable $3.6 million allocation. The funds, which have been obligated by the federal government, cannot be recognized as assets or receivables until the city incurs costs related to the expenses. This means that the city must first spend the money before it can officially record it in its financial statements.

The conversation highlighted the importance of accelerating the use of these funds to bring them under the city's control. Currently, the funds are not reflected in the city’s accounts, as they are categorized as reimbursements rather than direct assets. This situation has prompted city officials to seek ways to expedite the process, ensuring that the funds are utilized effectively for community projects.

A key point raised during the meeting was the distinction between how these funds are recorded in financial statements. Until the city incurs eligible costs and applies for reimbursement, the funds remain unaccounted for on the balance sheet. Instead, they will appear as expenses on the income statement once the city begins to utilize them.

This discussion underscores the complexities of municipal finance and the necessity for strategic planning in managing federal funds. As the city looks to navigate these financial intricacies, the focus remains on ensuring that the allocated funds are effectively used to benefit the community, rather than remaining dormant within federal accounts. The commission's efforts to clarify these financial processes are crucial for future budgeting and project planning, as they aim to enhance transparency and accountability in the use of public funds.

The conversation highlighted the importance of accelerating the use of these funds to bring them under the city's control. Currently, the funds are not reflected in the city’s accounts, as they are categorized as reimbursements rather than direct assets. This situation has prompted city officials to seek ways to expedite the process, ensuring that the funds are utilized effectively for community projects.

A key point raised during the meeting was the distinction between how these funds are recorded in financial statements. Until the city incurs eligible costs and applies for reimbursement, the funds remain unaccounted for on the balance sheet. Instead, they will appear as expenses on the income statement once the city begins to utilize them.

This discussion underscores the complexities of municipal finance and the necessity for strategic planning in managing federal funds. As the city looks to navigate these financial intricacies, the focus remains on ensuring that the allocated funds are effectively used to benefit the community, rather than remaining dormant within federal accounts. The commission's efforts to clarify these financial processes are crucial for future budgeting and project planning, as they aim to enhance transparency and accountability in the use of public funds.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting